2 Mar 2018: India import tax hike against palm oil rattles traders

Editor's note: Here's my summary of some high-key palm oil trade issues in selected countries. The news on the India import tax hikes against palm oil hit today. The Khor Reports team has our heads down in the data and maps, but we are told "traders here freaking out over India tax hike."

18 Jan 2018: EU Parliament has voted to exclude palm oil from the EU-RED, Brent Crude $69.38

18 Jan 2017: EU Parliament has voted to exclude palm oil from the EU-RED. What's next? What can you do?

https://khorreports-palmoil.blogspot.my/2014/07/biodiesel-news-update-5.html

Bursa Malaysia crude palm oil futures fall on concerns over EU Parliament vote on RED II provisions Singapore (Platts)--17 Jan 2018 https://www.platts.com/latest-news/agriculture/singapore/bursa-malaysia-crude-palm-oil-futures-fall-on-27906122

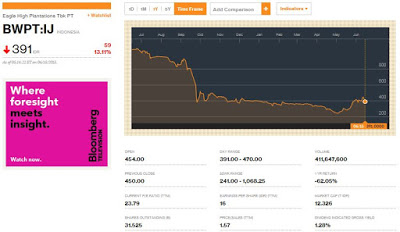

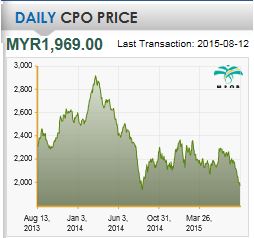

30 Dec 2017: Malaysian palm oil price sheds 20% in 2017, Brent Crude $66.87

Malaysian palm oil price sheds 20% in 2017, 30 Dec 2017 - Palm oil prices have been trending downwards since November, after India raised import taxes on edible oils to their highest in more than a decade, cutting demand. https://www.thestar.com.my/business/business-news/2017/12/30/malaysian-palm-oil-price-sheds-20-in-2017/#OaEfp7Jfis4dQKhd.99

Oil Resurrection Sets Stage for Another OPEC-Shale Clash in 2018 By Catherine Traywick , Heesu Lee , and Grant Smith December 29, 2017 https://www.bloomberg.com/news/articles/2017-12-29/oil-resurrection-sets-stage-for-another-opec-shale-clash-in-2018

20 Sep 2017: Dr James Fry presentation, China policy favours domestic ethanol, IOI de-integrates Loders Croklaan, trade tussles and the "unhealthy commodity" label, Brent Crude $55.14

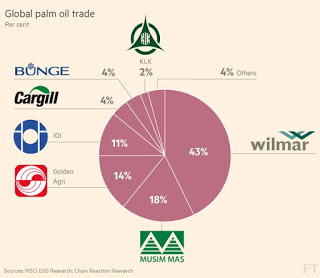

Editor's note: I'm sitting in a rain-soaked and surprisingly cool Kuala Lumpur these few days - it's raining in the morning as well as the afternoon. Bad flash floods even hit Penang in northern Peninsular Malaysia. Increased pessimism on biodiesel outlook is obvious among specialists in the palm sector - with US and EU short term policy hits on imports as well as medium-longer term concerns as China affirms domestic ethanol for its biofuel (it seeks to lift rural incomes, not add to money flow leakages) and technological disruption stares the need-subsidy-forever biodiesel segment in the eye. Buyers ask when lower prices are coming, and they should keep an eye on recovery of production. More negative news is starting to build up on palm on enviro-social issues, in the widely expected cyclical news run up to the annual November RSPO meeting. The corporate surprise is the apparent de-industrialisation / de-integration of IOI Group as it sells its Loders Croklaan unit to Bunge (70% and the remainder may be sold within 5 years); and Bunge will be the buyer of half of the Malaysian group's palm oils. Southeast-Asia based analysts write of IOI using its RM2.5 billion net gain/ RM4 billion proceeds to expand upstream (and this is expected to comply with tough sustainability - IOI has promised RSPO Next). Or maybe more real estate deals for this palm and property giant? To be sure, palm exporters are ever worried about the EU market as palm volumes there have shrunk in non-energy uses and the all-important energy sector faces up to political and policy noises. Heading to Paris-Brussels soon, so get in touch for a policy-trade views update.

China pushes for full scale bio-fuel ethanol E10 by 2020 - but experts point to feedstock limitations

http://khorreports-palmoil.blogspot.my/2017/09/china-pushes-for-full-scale-bio-fuel.html

; a temporary dampener on Malaysia-Indonesia hopes for China B5?

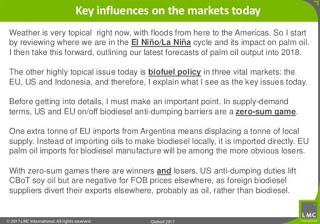

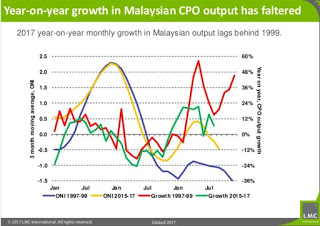

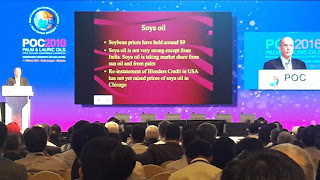

Dr James Fry, LMC International - Globoil Presentation - Sept 17

Top palm oil firms facing EU firing rethink trade strategy -

Major producers in Indonesia and Malaysia are looking at new markets ranging from Africa to Myanmar SEP 14, 2017

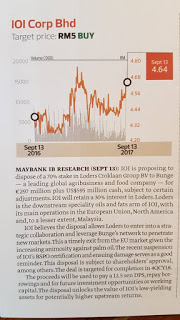

Bunge to buy 70 percent stake in IOI Corp unit for $946 million SEPTEMBER 12, 2017 -- “The market is perceiving that this takes them out of the M&A risk,” said Bill Densmore, senior director of corporate ratings at Fitch Ratings, noting that the share price had been elevated this summer by expectations of a takeover. The deal’s relatively high valuation cost of more than 12 times IOI Loders’ estimated 2018 EBITDA and the increased debt from the transaction will make the Bunge a more expensive takeover target, said Farha Aslam, analyst with Stephens Inc.

Source: Maybank quoted in The Edge Malaysia 18 Sep 2017, the IOI sale of its key downstream unit is seen here as a "timely exit from the EU market given the increasing animosity against palm oil", a lesson from damage from the RSPO suspension and potential to refocus on higher return upstream business.

News wrap, July - Sep 2017

World Bank on "unhealthy commodities"

Cut subsidies for unhealthy commodities and regulate junk food marketing, says World Bank By David Burrows 17-Aug-2017

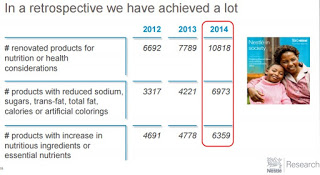

Subsidies should be re-targeted towards fruit and vegetable production rather than “unhealthy ingredients for food processing” such as sugar, corn and palm oil, the economists said. Note: unhealthy commodities defined as oils, solid fats, sugars, salt, flours, starches

http://mobile.foodnavigator.com/Policy/Cut-subsidies-for-unhealthy-commodities-and-regulate-junk-food-marketing-says-World-Bank

Trade tussles - FTAs, product safety and health

Ambank wrote: Bloomberg reported that US has proposed import duties on biodiesel from Argentina and Indonesia. Initial results of a Commerce Department probe indicated that the duties should be 50.3% to 64.2% on Argentine biodiesel imports and 41.1% to 68.3% on Indonesian biodiesel imports. The Commerce Department will announce on 7 November if the duties are finalised. Separate action by the International Trade Commission will follow thereafter.

Positive response from Iran on palm oil duty cut http://www.thestar.com.my/business/business-news/2017/02/07/positive-response-from-iran-on-palm-oil-duty-cut/#ZL8BigJF5h3y7J1D.41

Malaysia - Minister: Palm oil export to Iran to grow by 40% under FTA http://www.thestar.com.my/business/business-news/2017/02/08/mah-palm-oil-export-to-iran-to-grow-by-40-under-fta/#vvaAK70jxqAD7sJk.41

Pakistan - PFA panel recommends banning banaspati ghee https://tribune.com.pk/story/1432984/pfa-panel-recommends-banning-banaspati-ghee/

India - Mention palm oil content on labels of food products http://timesofindia.indiatimes.com/india/mention-palm-oil-content-on-labels-of-food-products/articleshow/59827953.cms

Palm oil free certification scheme launched By Katy Askew 14-Aug-2017

http://mobile.foodnavigator.com/Market-Trends/Palm-oil-free-certification-scheme-launched?

FDA okays Bunge petition on soybean oil health claims: Food companies and restaurants may make qualified health claims linking consumption of soybean oil to reduced risk of coronary heart disease, the U.S. Food and Drug Administration (FDA) announced July 31. The FDA decision was issued in response to a February 2016 petition from Bunge North America, St. Louis, Missouri, U.S.,the North American business Bunge Ltd. The FDA said it would allow companies to communicate that soybean oil may reduce the risk of coronary heart disease and may lower LDL-cholesterol when replacing saturated fats and not increasing caloric intake. The Bunge petition featured a summarization of human clinical trials demonstrating the heart health potential of soybean oil. http://www.world-grain.com/articles/news_home/World_Grain_News/2017/07/FDA_okays_Bunge_petition_on_so.aspx?ID=%7B0A85F4DB-372A-45C3-8ECA-F9C5ABFDCCE2%7D&cck=1

Biodiesel pessimism amidst technological disruption

The death of the internal combustion engine. It had a good run. But the end is in sight for the machine that changed the world Aug 12th 2017

https://www.economist.com/news/leaders/21726071-it-had-good-run-end-sight-machine-changed-world-death?frsc=dg%7Ce

Shell braces for 'lower forever' oil amid electric vehicle boom The Telegraph, July 27, 2017 -- .... On Wednesday the UK followed France’s pledge to halt the sale of internal combustion vehicles by 2040, just weeks after the world’s fastest growing economies, China and India, also called time on traditional fuel engines.... Mr Van Beurden said the “absolutely necessary” backing was welcomed by the oil group, which is already taking into account a “very aggressive scenario” in which oil use could peak in the 2030s.... The forecast tipping point is a full decade earlier than predictions from the International Energy Agency... https://www-yahoo-com.cdn.ampproject.org/c/s/www.yahoo.com/amphtml/finance/news/shell-profits-surge-van-beurden-064138951.html

Britain to ban sale of all diesel and petrol cars and vans from 2040, 25 July 2017 -- The commitment, which follows a similar pledge in France, is part of the government’s much-anticipated clean air plan, which has been at the heart of a protracted high court legal battle.... The government warned that the move, which will also take in hybrid vehicles, was needed because of the unnecessary and avoidable impact that poor air quality was having on people’s health. Ministers believe it poses the largest environment risk to public health in the UK, costing up to £2.7bn in lost productivity in one recent year. https://amp.theguardian.com/politics/2017/jul/25/britain-to-ban-sale-of-all-diesel-and-petrol-cars-and-vans-from-2040

More here... Biodiesel news: The technology transition outlook (is oil the new coal?), US import duties on Musim Mas, Wilmar and others, "abject coalfields"

http://khorreports-palmoil.blogspot.my/2014/07/biodiesel-news-update-5.html

7 July 2017: France to ban sales of petrol and diesel cars by 2040, China Geely-Volvo shifts to all electric-hybrid from 2019, Brent $47.44

Editor's note: Maybe Malaysia could aim to export Geely-Volvo electric-hybrids instead of palm oil for biodiesel? Fascinating that the apparent trigger is from China's auto industry. On the China domestic scene, recall that Indonesia eyes China biodiesel market for its palm oil. In my recent visit to Singapore, some top business observers feel that the hey-days for oil are not likely to come back. The indicators from energy geopolitics would seem to concur with so much investment to wean off a troublesome crude oil dependencies which come with uncomfortable ethno-religious problems. As for crop-based biodiesel, some major rethinks needed. Complacent assumptions of China and India buying cheap, no questions asked, is likely misplaced.

Target/mooted bans on sales of petro-diesel cars include:

- Norway 2025

- Netherlands 2025

- Germany (some states) 2030

- India 2030

- UK 2040

- France 2040

Will China Geely-Volvo's shift to all electric-hybrid trigger more EU countries to change policy on transport fuel mix to exit carbon fuel - petrol and (end scandal-ridden love affair with) diesel... France to ban sales of petrol and diesel cars by 2040 - Move by Emmanuel Macron’s government comes a day after Volvo said it would only make fully electric or hybrid cars from 2019, https://www.theguardian.com/business/2017/jul/06/france-ban-petrol-diesel-cars-2040-emmanuel-macron-volvo; and "European parliament draft inquiry into dieselgate has found EC ignored evidence of emissions test cheating" https://www.theguardian.com/environment/2016/dec/20/european-commission-guilty-negligence-diesel-defeat-devices-draft-report-dieselgate. Also note that 30,000 to 40,000 new Volvo vehicles target to be railed from Volvo plant in China to Zeebrugge each year, http://www.chinadaily.com.cn/business/2017-07/01/content_29957159.htm; and China Geely taking a large stake in Malaysia's Proton (consolidating its two plants, http://www.chinadaily.com.cn/business/motoring/2017-06/28/content_29921840.htm).

15 Jun 2017: Norway bans government purchasing of palm oil biofuel, antidumping campaign from EU and the US NBB, Indonesia eyes China biodiesel market, Brent Crude $46.95

Editor's note: The EU Parliament vote also calls for an end to palm biodiesel

Norway bans government purchasing of palm oil biofuel 13 June 2017 / Morgan Erickson-Davis - The move may make Norway the world’s first country to ban palm oil in its public procurement -- The growth of the palm oil industry has been blamed for a host of damaging environmental impacts, such as deforestation and carbon emissions. Research indicates that biofuel made with palm oil may be even worse for the climate than fossil fuels. The Norwegian parliament responded to these impacts by voting in a regulation to its Public Procurement Act to stop using biofuel palm oil-based biofuel. The resolution further stipulates that the "regulatory amendment shall enter into force as soon as possible." Conservationists laud the move, but say more countries need to follow suit. They recommend the EU's biofuel policy be updated to reflect concerns about palm oil. https://news.mongabay.com/2017/06/norway-bans-government-from-purchasing-palm-oil-biofuel/

Indonesian biodiesel producers turn to China -- Indonesian Biofuel Producers Association (Aprobi) chairman MP Tumanggor stressed Thursday that their members could no longer rely on their exports to the US and European Union... “Our production capacity reaches 11 million kiloliters per year, 4 million of which is absorbed by the domestic market. The remaining 7 million kiloliters are idle,” he said, adding that exports to European countries and the US account for just a portion. The negative sentiment was sparked by an antidumping campaign from both the European Union and the US commercial trade association National Biodiesel Boards (NBB).... Aprobi secretary general Stanley Ma said that China was a potential market for Indonesian biodiesel because the country used B5 for its fuel, which consists of 5 percent biodiesel and 95 percent petroleum biodiesel. “China might need 9 million kiloliters of biodiesel a year. This could boost our exports,” he said. The Indonesian government is reportedly set to send a team to China on June 16 in an attempt to boost biodiesel exports to the country. http://www.thejakartapost.com/news/2017/06/09/indonesian-biodiesel-producers-turn-to-china.html

26 Apr 2017: USA trade issues - FDA culls foreign food facility registration, Trump worries about Canada lumber and dairy

FDA culls huge number of foreign food facility registrations By Hank Schultz, 25-Apr-2017 In its latest cleanup of its food facility registration database, the U.S. Food and Drug Administration has culled an eye-opening 28% of existing registrations. The biggest drops happened in overseas sites. http://www.foodnavigator.com/Policy/FDA-culls-huge-number-of-foreign-food-facility-registrations

Canada Reacts Coolly to U.S. Move on Lumber - Prime Minister Justin Trudeau says trade irritants with U.S. ‘nothing new,’ can be resolved By Paul Vieira April 25, 2017 -- Trudeau said Tuesday he intended to speak firmly yet reasonably with President Donald Trump about the U.S. slapping a 20% tariff on softwood lumber from Canada and Mr. Trump’s escalating rhetoric over Canadian dairy trade practices. https://www.wsj.com/articles/canada-reacts-coolly-to-u-s-move-on-lumber-1493148815?

Trump slaps first tariffs on Canadian lumber by Patrick Gillespie @CNNMoney April 25, 2017 -- The Trump administration is hitting Canada with stiff tariffs of up to 24% on lumber shipped into the United States..... Trump's tariffs come as the U.S., Canada and Mexico prepare to renegotiate NAFTA, the 1994 free trade agreement. Trump has directed almost all of his NAFTA criticism at Mexico, which makes this decision even more surprising. http://money.cnn.com/2017/04/24/investing/canada-lumber-tariff-trump/index.html?

Why's Trump threatening Canada over milk? President Trump has slapped tariffs on Canadian lumber - now he's going after their dairy farmers. Why?

http://www.bbc.com/news/av/39724043/whys-trump-threatening-canada-over-milk

25 Apr 2017: Reuters - traders eye Ramadan demand, pick up from 8 month low, more clampdown in China's shadow finance system, Brent Crude $51.83

China’s shadow finance system - turbulence has centered on so-called entrusted investments -- funds that Chinese banks farm out to external asset managers....banks’ withdrawals helped erase $183 billion of stock market value last week and sent bond yields to the highest level in nearly two years

..https://www.bloomberg.com/news/articles/2017-04-24/china-markets-reel-as-banks-unwind-1-7-trillion-in-shadow-funds

VEGOILS-Palm sees second day of gains, traders eye Ramadan demand - Reuters News 21-Apr-2017 06:41:35 PM * Palm hits intraday high of 2,535 rgt/T, strongest in a week * Market also up on technical correction - Trader

VEGOILS-Malaysian palm hits 8-month low as rival oils weaken - Reuters News 19-Apr-2017 06:57:48 PM * Palm down nearly 7 percent since start of April * Expectations of rising output, weaker demand - trader

13 Apr 2017: Palm trades at 6-month lows, BMD RM2,589/$585

VEGOILS-Palm trades at 6-month lows on stronger output, weaker overnight soy - Reuters News 12-Apr-2017 06:42:37 PM By Emily Chow * Palm fell to six-month low of 2,568 rgt/T * Market sees fourth decline in five sessions

3 Apr 2017: Malaysian palm oil price falls to 5-mth low, US and EU biodiesel dumping claims on Indonesia (and overall commodity exports sector shrinking), MEPs to Vote on Sustainable Palm Oil Report, BMD RM2,646/$598

Malaysian palm oil price loses gains, falls to 5-mth low 1 April 2017 Read more at http://www.thestar.com.my/business/business-news/2017/04/01/palm-loses-gains-falls-to-5-mth-low/#cXqerqA3UwL6DMlr.99

Palm oil producers revise up palm oil production, stock data, Stefani Ribka, The Jakarta Post, Jakarta | March 28, 2017 -- GAPKI predicts that the CPO price will hover around US$720 to $750 per ton in this month end after reaching $722.5 to $765 per ton during the first two weeks of this month. http://www.thejakartapost.com/news/2017/03/28/palm-oil-producers-revise-up-palm-oil-production-stock-data.html

New biodiesel dumping claim weighs on RI’s shoulders by Viriya P. Singgih, The Jakarta Post, Jakarta | Sat, March 25, 2017 - As though adding insult to injury, American biodiesel producers have followed the European Union’s (EU) lead in accusing Indonesia of dumping practices, less than a week before the latter’s first meeting to clear its name with the WTO. The United States-based commercial trade association National Biodiesel Board (NBB), along with dozens of its fellow biodiesel producers, filed a petition on Thursday with the US Department of Commerce and the US International Trade Commission to impose anti-dumping and countervailing duties on imports of biodiesel from Argentina and Indonesia. http://www.thejakartapost.com/news/2017/03/25/new-biodiesel-dumping-claim-weighs-on-ris-shoulders.html

EDITORIAL: EU policy unjustifiable, The Jakarta Post, Jakarta | Fri, March 24, 2017 -- We find it mind-boggling trying to understand the European Union’s stubborn policy to maintain the 2013 anti-dumping duties on the importation of Indonesian biodiesel, despite a court ruling last year that annulled the duties. The court ruled last September that Indonesian domestic palm oil prices were not regulated... http://www.thejakartapost.com/academia/2017/03/24/editorial-eu-policy-unjustifiable.html

MEPs to Vote on Sustainable Palm Oil Report, 03 Apr 2017 --- MEPs will debate a report calling on the European Commission to take measures to phase out palm oil in biofuels and a single certification scheme for the commodity to enter the EU market, later today (April 3), ahead of a vote scheduled for tomorrow. http://www.foodingredientsfirst.com/news/MEPs-to-Vote-on-Sustainable-Palm-Oil-Report?type=article

Malaysia grateful to France for rejecting ‘unfair’ palm oil tax 29 March 2017 -- Read more at http://www.thestar.com.my/news/nation/2017/03/29/merci-beaucoup-monsieur-hollande-malaysia-grateful-to-france-for-rejecting-unfair-palm-oil-tax/#UtESuqG9BLZ7ypBd.99

Indonesia, France talk about palm oil and aircraft industry by Anton Hermansyah, The Jakarta Post, March 29, 2017, http://www.thejakartapost.com/news/2017/03/29/indonesia-france-talk-about-palm-oil-and-aircraft-industry.html

Tasmanian dairy uses palm oil spin-off in its cow feed - The Australian, April 3, 2017 -- Chief executive David Beca stressed that the product — which is linked to deforestation in Southeast Asia, including of orangutan habitats, as well as to biosecurity breaches and altered fat levels in milk — had certification by the Roundtable on Sustainable Palm Oil. “(It is) the highest ethical and environmental standard accepted in Europe,” Mr Beca said. “PKE is a feed source of high protein and energy, which is safe to feed to milking cows, dry stock and young calves.” http://www.theaustralian.com.au/business/tasmanian-dairy-uses-palm-oil-spinoff-in-its-cow-feed/news-story/04324c9ca5e93580c7a89804185901b5

Snake eats human in Sulawesi, under pressure of deforestation: Expert by Andi Hajramurni, The Jakarta Post, Makassar | Wed, March 29, 2017 -- According to Rahmansyah, the forest was the python’s natural habitat but had continued to expand into a palm oil plantation. “It’s becoming more difficult for the animals to find their natural food,” he said.... http://www.thejakartapost.com/news/2017/03/29/snake-eats-human-on-sulawesi-under-pressure-of-deforestation-expert.html

Environmental Damage, Social Conflicts Overshadow Future of Indonesia's Palm Oil Sector By : Ratri M. Siniwi & Muhamad Al Azhari | March 21, 2017 -- Palm oil is an important commodity for Indonesia's economy, contributing $17.8 billion, or about 12 percent, to its export revenue. While this year the production of crude palm oil is likely to increase 16 percent, to up to 33 million tons, with expected conducive weather conditions, environmental issues and social conflicts continue to overshadow the sector's future in the world's biggest palm-oil producing country. http://jakartaglobe.id/business/environmental-damage-social-conflicts-overshadow-future-indonesias-palm-oil-sector/

Gov't Encourages Palm Oil Farmers to Grow Corn -- Only 3.7 million hectares of farmland in Indonesia is used to grow corn, according to data released by the Central Statistics Agency (BPS). In total, the country produced 19.6 million metric tons of the crop in 2015. By : Dion Bisara | March 20, 2017 http://jakartaglobe.id/business/govt-encourages-palm-oil-farmers-grow-corn/

Indonesia Pays Price of Protectionism as Commodity Exports Sink by David Roman March 29, 2017 -- Lower resource exports becoming drag on economic growth: DBS. Commodities’ share of GDP has halved over past five years. Commodities now account for about 40 percent of all exports, down from almost 60 percent five years ago, according to Morgan Stanley. They make up just 6 percent of gross domestic product, half as much as in 2012, as trade restrictions worsened the impact of a price rout over much of that period. Crude oil and gas output has declined to levels last seen in the early 1970s....“Indonesia is growing 5 percent -- that’s pretty good -- but it used to grow 6 percent because of commodities. To go back to 6 percent you need to have another sector that would replace it,” said Gundy Cahyadi, an economist at DBS Group Holdings Ltd. in Singapore. “The problem is that there is no support from manufacturing.”....https://www.bloomberg.com/news/articles/2017-03-28/indonesia-pays-price-of-protectionism-as-commodity-exports-sink

372 settlers lose suit against Felda over palm oil extraction rates, 31 March 2017, BY MAIZATUL NAZLINA -- PUTRAJAYA: A total of 372 settlers in two Felda schemes who filed a suit against the authority and its subsidiary over palm oil extraction rates will have to pay RM472,000 in costs after losing their case in two courts. On June 27, 2015, then Seremban High Court judge Justice Zabariah Mohd Yusof directed the settlers to pay RM1,000 each to Felda and Felda Palm Industries Sdn Bhd.... Court of Appeal judge Justice Abang Iskandar Abang Hashim ordered the settlers from the Serting Hilir and Raja Alias schemes in Negri Sembilan to pay a "global sum" of RM100,000 in cost to the two defendants. The court granted the cost after Felda and Felda Palm Industries counsel Mohd Hafarizam Harun submitted that various complex issues were rebutted and voluminous documents tendered in the three-day hearing.... Counsel for the settlers R. Sivarasa asked for RM10,000 in cost, saying that there were occasions when the court only sat for a half a day to hear the matter. Read more at http://www.thestar.com.my/news/nation/2017/03/31/372-settlers-lose-suit-against-felda-over-palm-oil-extraction-rates/#UeqxPqIbHEVfOFhI.99

18 Mar 2017: El Nino 2017 question, Indonesia questions inequality of land ownership, Malaysia criticises EU Parliament resolution on palm oil, more labels in Europe, BPDP issues, BMD RM2804

Malaysian palm oil price rebounds on stronger demand forecasts 18 March 2017 Read more at http://www.thestar.com.my/business/business-news/2017/03/18/palm-rebounds-on-stronger-demand-forecasts/

Weak El Nino to Have Small Impact on Asian Crops This Year: MDA Weather By : Naveen Thukral | March 15, 2017 http://jakartaglobe.id/international/weak-el-nino-small-impact-asian-crops-year-mda-weather/

Global palm oil output likely to rise by 6 million tonnes 8 March 2017, Read more at http://www.thestar.com.my/business/business-news/2017/03/08/global-palm-oil-output-likely-to-rise-by-6-million-tonnes/#WFQo25WA9Kq63Es0.99

Malaysia strongly opposes EU parliament resolution on palm oil 15 March 2017 Read more at http://www.thestar.com.my/business/business-news/2017/03/15/malaysia-strongly-opposes-eu-parliament-resolution-on-palm-oil/

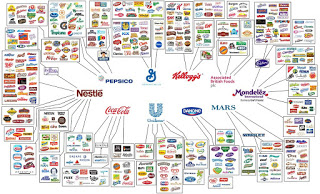

Six industry giants to launch UK-style traffic light labels in Europe By Niamh Michail+, 08-Mar-2017 -- Coca-Cola, Mars, Mondelez, Nestlé, PepsiCo and Unilever will add nutrition logos modelled on the UK’s traffic light label to their European portfolios. However, critics have slammed the use of portion size as a reference. http://www.foodnavigator.com/Policy/Six-industry-giants-to-launch-UK-style-traffic-light-labels-in-Europe

DARMIN NASUTION, MENTERI KOORDINATOR BIDANG PEREKONOMIAN - BPDP Jangan Hanya Jadi Kasir, Untuk program biodiesel, hasilnya relatif bagus. Tapi program yang lain, peremajaan kebun sawit rakyat praktis tidak ada hasil. 7/3/2017, Industri Opini http://katadata.co.id/opini/2017/03/07/bpdp-jangan-hanya-jadi-kasir

Note: For the biodiesel program, the results are relatively good. But for other programs, such as rejuvenating smallholder oil palm, there are practically no results.

EDITORIAL: Inequality in asset ownership, The Jakarta Post March 16, 2017 -- The Agrarian and Spatial Planning Ministry has set itself a target of granting 5 million land titles this year at a cost of Rp 2 trillion (US$148 million), which will be fully financed by the state budget. Land titles will empower the poor to take maximum benefit from their physical assets, such access to bank loans. Usually, registering a property can be an arduous and costly procedure. Ministry data shows that of the 136 million plots of private land across the country, only 46 million plots have legal titles... Encouraged by the smooth implementation of a land reform pilot project last year, the ministry will also speed up the redistribution of neglected land, estimated at 12.7 million hectares across the country, to landless people around forests through local customary communities.,,Many plantation companies hold land concessions of more than 500,000 ha, or more than six times the land area of Singapore. We are afraid that if the expansion of plantations, especially oil palm, by big companies remains at its current rate of more than 100,000 ha per year, mounting problems of inequality of income, wealth and land conflicts could threaten the long-term sustainability of the plantation industry, even the macroeconomic stability.

National park fights back against illegal plantations, Apriadi Gunawan, The Jakarta Post March 11, 2017 http://www.thejakartapost.com/news/2017/03/11/national-park-fights-back-against-illegal-plantations.html -- More than 2,000 hectares within the National Park had been converted into plantations, which were mostly spread throughout Langkat, North Sumatra and Southeast Aceh. The forest conversions were mostly committed by local people who were supported by payments from outside investors. “Most of the investors come from Medan,” Joko said...http://www.thejakartapost.com/news/2017/03/11/national-park-fights-back-against-illegal-plantations.html

11 Mar 2017: EU politicians question palm oil usage in biofuels and seek single certification scheme, price outlook, output to surge

On 9 Mar, European politicians backed (56 to 1) a non-binding report on sustainable palm oil (to be put to full House vote in April for phase-out from biofuel usage of deforestation producst by 2020 and a single certification scheme)... http://www.foodingredientsfirst.com/news/MEPs-Fight-Against-Unsustainable-Palm-Oil-Entering-EU-Market.html -- In her report Konečná calls on the European Commission to strengthen environmental measures to prevent palm oil-related deforestation and phase out the use of palm oil as a component of biodiesel by 2020. Products should also be able to be certified for the socially responsible origin of their palm oil. “I believe that the European Parliament should be very ambitious," she said. "There should not be any palm oil in biofuels." The environment committee votes on the report on 9 March. It will then be up to all MEPs to vote on it during an upcoming plenary session. http://www.europarl.europa.eu/news/en/news-room/20170306STO65231/palm-oil-the-high-cost-of-cultivating-the-cheap-vegetable-oil

Mistry sees CPO at RM3,000 BY P. ARUNA, 9 March 2017 - Price level based on likelihood of another El Nino, Read more at http://www.thestar.com.my/business/business-news/2017/03/09/mistry-sees-cpo-at-rm3000/#l0GQ0U92kzciGPwF.99

Trump and a possible El Nino may confound palm oil market bears 6 March 2017 | Read more at http://www.thestar.com.my/business/business-news/2017/03/06/trump-and-a-possible-el-nino-may-confound-palm-oil-market-bears/#dBys0YyUlMmLjvwh.99

CPO output expected to surge this year BY P. ARUNA 11 March 2017 http://www.thestar.com.my/business/business-news/2017/03/11/cpo-output-expected-to-surge-this-year/

Malaysia, Indonesia Biodiesel Production Forecast to Rise in 2017 By : Emily Chow | March 07, 2017 http://jakartaglobe.id/business/malaysia-indonesia-biodiesel-production-forecast-rise-2017/

Free Trade Push: Australia, Indonesia Eye Deal - After a summit meeting, Australia and Indonesia’s leader pledge to complete a bilateral deal by the end of 2017. By Anthony Fensom February 27, 2017 http://thediplomat.com/2017/02/free-trade-push-australia-indonesia-eye-deal/

Australian leader to continue free-trade talks in Indonesia by Rod McGuirk Associated Press Canberra | Mon, March 6, 2017 http://www.thejakartapost.com/seasia/2017/03/06/australian-leader-to-continue-free-trade-talks-in-indonesia.html

27 Feb 2017: Indonesia's EU-targeted palm legality scheme and 83-90% "undisturbed natural habitat" for Papua, Malaysia announces mandatory MSPO (end 2018-end 2019) for sustainable and safe palm oil

Editor's note: With EU market access concerns, Malaysia moves belatedly on mandatory national sustainability certification for its palm oil; a food safety element appears in news reports and we are not sure what upgrades will feature in MSPO to tackle the 3MCPD/GE issues. Indonesia's mandatory ISPO scheme has already existed for several years and has reached the stage of upgrade; Indonesia is also moving (from a perceived laggard position) on a palm legality scheme, high-grade conservation for Papua and peatland restoration.

Malaysian palm oil price recovers on better demand, but sees 2nd weekly fall 5 February 2017 - http://www.thestar.com.my/business/business-news/2017/02/25/palm-oil-recovers-on-better-demand/#yVxiTq21jMYHp0CX.99

Ministry sets timeline for MPSO certification mandatory compliance February 24, 2017 -- Its Minister Datuk Seri Mah Siew Keong said the compliance would be implemented in stages with plantation players that were certified with Roundtable on Sustainable Palm Oil (RSPO) to comply with the MSPO certification by Dec 31, 2018. Those without RSPO certification would need to comply by June 30, 2019 and all smallholders by Dec 31, 2019, he said...http://english.astroawani.com/malaysia-news/ministry-sets-timeline-mpso-certification-mandatory-compliance-133528

Working to improve the palm oil industry 26 February 2017 - On Friday, Mah told reporters that by the end of 2019, it would be mandatory for local companies to comply with the Malaysian Sustainable Palm Oil (MSPO) certification scheme, which requires oil palm growers and palm oil processors to meet certain sustainability standards. This is a move towards branding Malaysian palm oil as sustainably produced and safe. http://www.thestar.com.my/opinion/columnists/the-star-says/2017/02/26/working-to-improve-the-palm-oil-industry/#Sekc1p7mMyqzWy4y.99

Indonesia ups efforts to gain EU recognition for palm oil by Hans Nicholas Jong February 23, 2017 -- The government planned to develop a palm oil legality scheme, similar to its domestic timber legality system (SVLK) implemented in 2013, which has gained recognition as the world’s only timber legality scheme acknowledged by the EU. The legality scheme for palm oil is expected to improve the reputation of the country’s palm oil industry, Environment and Forestry Minister Siti Nurbaya Bakar said.... “Because the palm oil industry is constantly protested internationally for allegedly creating problems, we have to find instruments that are internationally accepted,” she said on Wednesday. http://www.thejakartapost.com/news/2017/02/23/indonesia-ups-efforts-to-gain-eu-recognition-for-palm-oil.html

DRAMATIC CONSERVATION PLEDGE BY PAPUA, INDONESIA February 23, 2017 /Bill Laurance -- The 83 percent figure for conservation—which could reach as high as 90 percent—follows from a government plan that maps future development in the province....“This is a remarkable milestone—one that should echo around the world,” said Judith Dipodiputro, coordinator of Project Papua, an initiative of Indonesian President Joko Widodo that is promoting sustainable development in the region... http://alert-conservation.org/issues-research-highlights/2017/2/23/dramatic-conservation-pledge-by-papua-indonesia

COMMENTARY: Who will benefit from Jokowi's land reform? Adisti Sukma Sawitri February 21, 2017 http://www.thejakartapost.com/academia/2017/02/21/commentary-who-will-benefit-from-jokowis-land-reform.html

20 Feb 2017: Brazil and India news

Plantation Sector: Newsflow for week 13-17 February by AmBank research includes:

- www.agrimoney.com reported that Brazil is gearing up its infrastructure to take over USA's soybean market share following USA's withdrawal from the TPPA and potential renegotiation of the NAFTA. Work is forging ahead on a series of projects to re-route Brazil's soybean exports through the Amazon instead of travelling overland to the southern ports. This is expected to reduce transport costs by half. Currently, most of Brazil's soybean exports travel from the country's soy belt by road to ports in the south of the country.

- Solvent Extractors Association of India said that the country's palm oil imports fell by 11.6% MoM in January 2017. India's palm imports declined in January 2017 as there was sufficient supply of oilseeds from local farmers. Also, the currency crunch resulting from the demonetisation has slowed purchases by customers. Palm oil accounted for 64% of India's total vegetable oil imports in January 2017.

19 Feb 2017: Malaysian palm oil price hits 3-month low on rising output, slow export demand, delay in BPDP subsidy, Indonesia sales and exports up on commodity price rebound, BMD RM2,859 / $642

Malaysian palm oil price hits 3-month low on rising output, slow export demand 8 February 2017 Read more at http://www.thestar.com.my/business/business-news/2017/02/18/palm-oil-hits-3-month-low-on-rising-output-slow-export-demand/#ZFbSQlZoXFCy0Q20.99

MPSO certification compliance timeline to be announced soon BY PARVIN RAJ MOHAN 17 February 2017 http://www.thestar.com.my/business/business-news/2017/02/17/mpso-certification-compliance-timeline-to-be-announced-soon/#rshYC76iLOCFMTdB.99

Pembayaran Subsidi Biodiesel Tertunda QAYUUM AMRI

Feb 17, 2017 https://sawitindonesia.com/rubrikasi-majalah/berita-terbaru/pembayaran-subsidi-biodiesel-tertunda/

Note: When contacted by the editorial Sawit Indonesia, the BPDP-KS represented Edi Prabowo admitted biodiesel subsidy payment is delayed. "Payment of biodiesel subsidies is delayed because there are new billing requirements document completed in January and February," said Edi Wibowo, Director of Disbursement BPDP-KS via WhatsApp messaging services, on Thursday (16/2).

Motorcycle Sales Rise in January, Manufacturers Confident of a Rebound -- Domestic motorcycle sales rose 14 percent in January from the same month last year, boosted by demand from islands outside Java, where household income was on the rise thanks to recovery in global commodities price and government infrastructure spending. The manufacturers under Indonesian Motorcycle Industry Association (AISI) sold 473,879 motorcycles last month, compared to 416,263 in the same month a year ago, the association's data showed. "When the price of commodities, such as crude palm oil rises, farmers income would also increase and encourage them to buy motorcycles," Gunadi Sindhuwinata, AISI chairman, said on Thursday (09/02). http://jakartaglobe.id/business/motorcycle-sales-rise-january-manufacturers-confident-rebound/

Indonesia Jan Exports Surge More Than Expected on Rising Commodity Prices http://jakartaglobe.id/business/indonesia-jan-exports-surge-expected-rising-commodity-prices/

Three named suspects for feasting on orangutan in Kapuas | Sat, February 18, 2017 -- Kapuas Police chief Sr. Comr. Jukiman Situmorang said on Friday that after 10 people had been taken in for questioning on Tuesday, investigators had decided to name three plantation workers, identified by their initials AY, 30, EMS, 39 and ER, 23, suspects. The case is believed to have occurred at an oil palm concession owned by PT Susantri Permai,... in Tumbang Puroh village, on Jan. 28. The incident reportedly began when a worker was harvesting fruit before encountering and being chased by an agitated orangutan. The worker later told the story to AY who then went out to hunt down the animal, where he purportedly killed it with an air rifle and machete. The animal was then taken by AY and his two colleagues EMS and ER to a nearby camp to be dined on...http://www.thejakartapost.com/news/2017/02/18/three-named-suspects-for-feasting-on-orangutan-in-kapuas.html

17 Feb 2017: Malaysia palm oil exports to hit RM70bil target, Sime IPO this year?

Palm oil exports to hit RM70bil target, futures prices trading higher BY OOI TEE CHING - 16 FEBRUARY 2017 Read More : http://www.nst.com.my/news/2017/02/212980/palm-oil-exports-hit-rm70bil-target-futures-prices-trading-higher

Sime IPOs this year? BY YVONNE TAN 16 February 2017 Read more at http://www.thestar.com.my/business/business-news/2017/02/16/sime-ipos-this-year/#qQMkAY4fGG3wccbK.99

How palm oil intake may cause cancer Author: Wale Akinola UPDATED: 2 DAYS AGO -- Editor’s note: Red palm oil has come into the spotlight as a nutrient-rich staple food following numerous health researches that were able to establish the profound medical value of the oil. But recent researches have revealed that palm oil intake may cause cancer. In this piece, Naij.com reviews the importance of red palm oil vis-à-vis its propensity of causing cancer so that people could know the best way to use it. https://www.naij.com/1088221-osinbajo-amaechi-storm-imo-state.html

10 Feb 2017: Looking for output jumps, Indonesia exports and biodiesel view, GAPKI - university tie-ups, Malaysia talks up China ties, Thailand policy view

Palm Oil Could Drop to 2,500 Ringgit as Output Jumps: Analyst Fry - Malaysian palm oil prices could fall by about a fifth to 2,500 ringgit per tonne by third quarter of 2017 as production in top two producing countries is expected to rise, analyst James Fry said on Friday (03/02). By : Mayank Bhardwaj | on 3:00 AM February 04, 2017 http://jakartaglobe.id/asia-pacific/palm-oil-drop-2500-ringgit-output-jumps-analyst-fry/

Powerful lobby sought to ease Indonesia palm oil exports by Stefani Ribka The Jakarta Post Jakarta | Fri, February 3, 2017 -- With the absence of a special lobby group to promote their collective interests overseas, local crude palm oil (CPO) producers have set a moderate growth target for the commodity’s export this year. The Indonesian Palm Oil Producers Association (Gapki) expects to increase exports by 7.56 percent to 27 million tons this year from 25.1 million tons in 2016, while production will likely increase by 12 percent to 38.7 million tons in the world’s biggest producer of the commodity. Exports in 2016 dropped 5 percent from 25.1 million tons in 2015, which the association mainly attributed to the absence of special trade deals and a special body to intensify marketing efforts amid competition with Malaysia, the world’s second largest CPO -producing country. Local producers have also been introduced to the government’s mandatory biodiesel mix policy, in which CPO is used as a mix in biodiesel in the local market. “Exports in 2016 dropped slightly due to various factors, but we expect it to be temporary. We set a sober target for exports this year as we expect challenges to remain more or less the same,” GAPKI secretary-general Togar Sitanggang said at a press conference on Tuesday.http://www.thejakartapost.com/news/2017/02/03/powerful-lobby-sought-to-ease-indonesian-palm-oil-exports.html

Biodiesel on high demand as Indonesia turns to cleaner fuel by Viriya P. Singgih The Jakarta Post Jakarta | Sat, February 4, 2017 -- Indonesia started implementing the B20 policy in early 2016 for the transportation and industry sectors, while power plant sectors were obliged to blend 30 percent of biodiesel ( B30 ) at the same time. In November, the government began stipulating the implementation of the program to all gas stations in the country, including state-owned and private stations. Otherwise, each station would be charged Rp 6,000 (45 US cents) for each liter of non-blended diesel fuel sold. As a result, Indonesia was able to consume 2.7 million kiloliters of biodiesel domestically throughout the year, 91 percent of which was blended with subsidized diesel fuel and the rest blended with non-subsidized fuel. The figure fell slightly from the original target of 2.9 million kiloliters. http://www.thejakartapost.com/news/2017/02/04/biodiesel-on-high-demand-as-indonesia-turns-to-cleaner-fuel.html

Bayu Mundur, Dono Dirut Baru Badan Pengelola Dana Sawit, Apa Kata Mereka? February 8, 2017 By Indra Nugraha, dan Lusia Arumingtyas, Jakarta https://www.mongabay.co.id/2017/02/08/bayu-mundur-dono-dirut-baru-badan-pengelola-dana-sawit-apa-kata-mereka/

Note: Dono Boestami, former Director of PT Mass Rapid Transit (MRT) Jakarta as the new head of the BPDP.

Indonesia - Palm oil refineries may be 'clustered' to aid electricity production by Fedina S. Sundaryani The Jakarta Post Jakarta | Fri, February 3, 2017 -- The government is considering to group together palm oil refineries to make it easier to use palm oil waste to fuel power plants. Even though palm oil waste is expected to fuel a big part of the generation of 32 gigawatts (GW) of electricity that is supposed to come from renewable sources, the small size of plantations and refineries has made it difficult to procure sufficient oil from one source, said the Energy and Mineral Resources Ministry's new and renewable energy director general, Rida Mulyana. "We are currently studying the possibility of using a cluster system. So we may group six refineries in one cluster and transmit the waste to PLN together," he said during a seminar held by the Indonesian Employers Association (Apindo) on Friday. Data from the ministry shows that there is a potential to generate 12.5 GW of electricity from palm oil waste.... http://www.thejakartapost.com/news/2017/02/03/palm-oil-refineries-may-be-clustered-to-aid-electricity-production.html

Indonesia - Palm oil association, universities team up to prepare skilled workers by Viriya P. Singgih February 2, 2017 -- The Indonesian Palm Oil Producers Association (Gapki) has signed a memorandum of understanding (MoU) with the Indonesian Rectors Forum (FRI) on a link-and-match program to prepare skilled workers... “This year, we also want to persuade several universities, especially ones specializing in agricultural majors or located in palm oil producing regions, to collaborate with us in conducting specific research about the palm oil industry,” said Muryanto. The projected research areas include the utilization of peatland, preserving nature in oil palm plantation areas and technological innovations. “We also want to disseminate to young generations that the palm oil industry is actually not damaging to the environment, as long as you work properly,” Muryanto added. Gapki membership currently incorporates companies working on 644 oil palm plantations across the country.....http://www.thejakartapost.com/news/2017/02/02/palm-oil-association-universities-team-up-to-prepare-skilled-workers.html

Malaysia - Wee: Good China ties have boosted commodity prices 6 February 2017 Read more at http://www.thestar.com.my/news/nation/2017/02/06/wee-good-china-ties-have-boosted-commodity-prices/#d9f34zQcZFoSHGFL.99

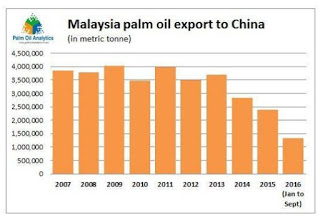

Malaysia overtakes Indonesia, 4 February 2017 -- TELUK INTAN: Malaysia has overtaken Indonesia as the biggest exporter of crude palm oil to China. Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong, who disclosed this, said that Datuk Seri Najib Tun Razak’s visit to China last November made this possible. He said Malaysia exported 993.9 thousand metric tonnes of crude palm oil to China from July to December last year. “This is a 53.6% increase over that period, while Indonesia’s export performance dropped 21%. “Six years ago we were the biggest palm oil exporters to China until Indonesia overtook us early last year,’’ he told reporters http://www.thestar.com.my/news/nation/2017/02/04/malaysia-overtakes-indonesia/#5TAdIAtAhc4z0I7y.99

Malaysia - Palm oil exports to India set to grow 5%-10% BY AZIZUL AHMAD 8 February 2017 http://www.thestar.com.my/business/business-news/2017/02/08/palm-oil-exports-to-india-set-to-grow-5-10pc/

Thailand - Democrats urge use of LNG, palm oil for power plants 8 Feb 2017 http://www.bangkokpost.com/news/politics/1195036/democrats-urge-use-of-lng-palm-oil-for-power-plants.

26 Jan 2017: Heavy rain in many states but to ease, US withdrawal from TPP affects Malaysia palm oil export target, FGV expands jetty ops in Pakistan, BMD RM3,125/$704

VEGOILS-Market factors to watch Jan 26 - Reuters News 26-Jan-2017 08:54:50 AM The following factors are likely to influence Malaysian palm oil futures and other vegetable oil markets. FUNDAMENTALS * Malaysian palm oil futures declined on Wednesday, tracking weaker performing rival soyoil and as traders closed positions ahead of the Lunar New Year public holidays. * U.S. soybean futures fell to a 1-1/2-week low on Wednesday on an improved South American crop weather outlook while corn edged higher on export demand, traders said. * Oil prices ended less than 1 percent lower on Wednesday after data showed a build in U.S. crude inventories, reinforcing the view that oil prices are range bound, buoyed by expected OPEC production cuts while pressured by U.S. output growth.

Heavy rain expected in all the other states, says Met Dept BY GAN PEI LING and SIMON KHOO 26 January 2017 -- Strong monsoon rains that have hit Negri Sembilan, Malacca and Johor are likely to ease by the weekend.... The high-tide phenomenon is also expected in Kuantan, Pekan and Rompin and the people are advised against going out to sea. Read more at http://www.thestar.com.my/news/nation/2017/01/26/only-perlis-to-enjoy-a-dry-cny-heavy-rain-expected-in-all-the-other-states-says-met-dept/#1oBQvxYG4eott3VW.99

US withdrawal from TPP affects palm oil export target, says Mah 24 January 2017 Read more at http://www.thestar.com.my/business/business-news/2017/01/24/us-withdrawal-from-tpp-affects-palm-oil-export-target-says-mah/#qt5S6EQP98Zqsx3k.99

FGV expands jetty ops in Pakistan 25 January 2017 -- FGV’s unit in Pakistan, FWQ Enterprises Pte Ltd, is building a 30,000-tonne terminal to handle and store liquid products such as ethanol, molasses and edible oils. “The move also serves as a launch pad for FGV to enter the Balkan countries,” he said. Zakaria said FGV expected the multi-purpose tank terminal to cost RM13mil and that the first 15,000 tonnes storage tanks had been installed in June, with the remaining 15,000 tonnes would be completed in 2017. He added that the terminal tanks could increase its capacity to 38,300 tonnes to meet rising demand.... Currently, FGV owns and operates the world’s largest edible oil terminal with a total capacity of 865,000 tonnes. Once fully operational, the bulking facilities in Port Qasim, Pakistan, will complement FGV’s existing bulking facilities in Malaysia and Indonesia for a combined capacity of 900,000 tonnes... Read more at http://www.thestar.com.my/business/business-news/2017/01/25/fgv-expands-jetty-ops-in-pakistan/#tuefYaejtHDQfWqj.99

A4042 reopened near Abergavenny after lorry crash spills palm oil - A lorry overturned and spilled palm oil which "set like wax" on the A4042 between Abergavenny and Llanellen at about 21:00 GMT on Tuesday. http://www.bbc.com/news/uk-wales-south-east-wales-38741491

21 Jan 2017: Nutella debate adds sugar concern, Ferrero refines its oil differently, Turkey to investigate products including palm oil

Products including palm oil to be investigated: Agriculture Minister Çelik, ISTANBUL January/16/2017 -- Food, Agriculture and Livestock Minister Faruk Çelik has said his office has launched work to detect food thought to include palm oil in its ingredients, state-run Anadolu Agency has reported. The ministry issued a statement on Jan. 15 after media reports on controversial palm oil, saying it was considered necessary to conduct an investigation based on public health concerns. http://www.hurriyetdailynews.com/products-including-palm-oil-to-be-investigated-agriculture-minister-celik.aspx?pageID=238&nid=108606&NewsCatID=341

Deconstructed Nutella: nuts, cocoa – and 58% sugar - A photograph of its raw ingredients has shocked fans of the spread. But is it really any worse than jam or marmalade? -- Well, someone in Germany has recreated a jar showing the ingredients in layers, and you can see it’s basically half sugar. Holy moly! And about a third fat. Roly-poly holy moly! Indeed. People are often shocked to see what’s in their favourite snacks.... See! But have you ever made jam? I have not. Well, that’s got a lot of sugar in it, too: 50% in the case of Hartley’s strawberry jam; 65% in Daylesford Organic. Even Frank Cooper’s Original Oxford Marmalade is 54%. Rowse honey is 81%. Sweet spreads are mostly sugar. Just don’t eat bowls of them. How about the fat then? All right. There’s not much fat in jam. (Unless you butter your toast first.) Nutella, however, is 32% fat, most of which is palm oil. The second most evil of all the oils! ... How about the cancer risk? I heard palm oil gives you cancer. Look, high-temperature refining may lead to more potentially carcinogenic contaminants, according to the European Food Safety Authority, but it doesn’t necessarily think it’s unsafe. Besides, Ferrero says it doesn’t refine its oil that way. People want food to be simple and dramatic, when it’s a hugely complex web of … I’m bored. Yeah. That’s what I mean....

https://www.theguardian.com/lifeandstyle/shortcuts/2017/jan/20/is-nutella-really-that-bad-for-you

What's in a jar of Nutella? A viral image shows the hazelnut spread is mostly sugar. By Alex Orlov January 19, 2017 -- A viral image posted to Reddit on Sunday can give you a taste for just how much of the sweet stuff is in each jar. (The image previously appeared with ingredients listed in German when it was used in an article that published Saturday on Die Welt, a German news site. The original image was created by Verbraucherzentrale Hamburg — the consumer center of Hamburg, Germany.)

https://mic.com/articles/165970/what-s-in-a-jar-of-nutella-a-viral-image-shows-the-hazelnut-spread-is-mostly-sugar#.S1kq00uxM

16 Jan 2017: Malaysia eyes CPO export duties, Nutella maker defends palm oil, Thailand floods

Nutella maker defends palm oil 12 January 2017 http://www.thestar.com.my/business/business-news/2017/01/12/nutella-maker-defends-palm-oil/

M’sia willing to talk on CPO export duties with Indonesia BY ZUNAIRA SAIEED 16 January 2017 http://www.thestar.com.my/business/business-news/2017/01/16/msia-willing-to-talk-on-cpo-export-duties-with-indonesia/

Catastrophic Thai floods expected to worsen as death toll rises BY REUTERS - 15 JANUARY 2017 http://www.nst.com.my/news/2017/01/204359/catastrophic-thai-floods-expected-worsen-death-toll-rises

Thailand floods kill at least 25 people and causes traffic jams 125 miles long - Nearly a million people have been affected by effects of unseasonable rain by Amy Sawitta Lefevre 10 January 2017 --More than 360,000 households, or about a million people, have been affected by the floods that have damaged homes and schools and affected rubber and palm oil production, the Department of Disaster Prevention and industry officials said.http://www.independent.co.uk/news/world/asia/thailand-floods-deaths-traffic-jams-rain-weather-latest-a7519316.html

Endless flood trauma for Malaysians (policy questions) 12 Jan 2017 by S Gopinath https://www.malaysiakini.com/letters/369058#ixzz4VsxR22yi

5 Jan 2017: Malaysia 2016 CPO price strongest annual gain in 6 years (BMD +25%), annual flooding season, CIMB sees RM3200 in Jan, output recovery in 2017

Editor's note: monsoon flooding of Peninsular Malaysia east coast is an annual affair.

From previous year: Malaysian palm oil output may drop again in January JANUARY 14, 2015 http://www.themalaymailonline.com/print/money/malaysian-palm-oil-output-may-drop-again-in-january and Malaysia's monsoon floods seen crippling December palm supply - industry Dec 26, 2014 http://www.reuters.com/article/palmoil-output-weather-idUSL3N0UA27020141226

(BFW) Malaysian Floods Hurting Some Palm Oil Plantations: KL Kepong By Anuradha Raghu (Bloomberg) -- Flooding has “severely affected” co.’s palm oil estates in Kelantan, according to Roy Lim, group plantations director at Kuala Lumpur Kepong, Malaysia’s 3rd- largest producer. * Harvesting, processing disrupted for 4th day in KL Kepong’s plantations in Kelantan and a palm oil mill has been marooned, Lim says Wednesday by phone * Typically, immediate impact of flooding to trees is loss of production, followed by quality problems * It’s still too early to tell extent of damage to production

Crude palm oil to trade up to RM3,200 in January, says CIMB Research 4 January 2017 http://www.thestar.com.my/business/business-news/2017/01/04/crude-palm-oil-to-trade-up-to-rm3200-in-january-says-cimb-research/

Palm oil - will output recover in 2017, and send the rally into reverse? 3rd Jan 2017, by Mike Verdin http://www.agrimoney.com/feature/palm-oil---will-output-recover-in-2017-and-send-the-rally-into-reverse--486.html

Malaysian palm oil price rises, closes with strongest annual gain in 6 years 31 December 2016 http://www.thestar.com.my/business/business-news/2016/12/31/palm-oil-rises-to-close-year-with-strongest-annual-gain-since-2010/

Indonesia's exports to still rely on primary commodities: HSBC by Winda A. Charmila, The Jakarta Post, January 3, 2017 -- http://www.thejakartapost.com/news/2017/01/03/ris-exports-to-still-rely-on-primary-commodities-hsbc.html

Consumer pressure to ditch deforestation begins to reach Indonesia’s oil palm plantation giants - A new report by Chain Reaction Research finds that some of the Southeast Asian nation’s biggest oil palm growers have issued stronger sustainability policies in response to interventions from their buyers. Will the trend continue? By Tara MacIsaac 28 December 2016 http://www.eco-business.com/news/consumer-pressure-to-ditch-deforestation-begins-to-reach-indonesias-oil-palm-plantation-giants/

The Chain: Dimensional Fund Advisors Divests From Some Palm Oil Positions to Mitigate Risks By GabrielThoumi on December 25, 2016 http://www.valuewalk.com/2016/12/chain-dimensional-fund-advisors-divests-palm-oil-positions-mitigate-risks/

Palm Oil Divestment Goes Mainstream - World's First Broadly-Diversified "Deforestation Free" Global Equity Portfolios Now Available to Everyday Investors San Francisco - December 23, 2016 (Investorideas.com Newswire) http://www.investorideas.com/news/2016/renewable-energy/12231Mainstream.asp

21 Dec 2016: Reuters - Palm plummets on weak external markets, lower exports, BMD RM3,093 / $690

VEGOILS-Palm plummets on weak external markets, lower exports - Reuters News 20-Dec-2016 06:48:01 PM * Market tracks weak related oils, expects downtrend - traders

* Palm erases most of the gains last week * Exports drop 14.4 pct for Dec. 1-20 - cargo surveyor data By Liz Lee KUALA LUMPUR, Dec 20 (Reuters) - Malaysian palm oil futures fell on Tuesday, reversing last week's gains, as rival oils fell and poor export data spooked the market.

5 Dec 2016: Friday - Palm hits four-year high before easing on weaker soyoil, BMD RM3,076/$691

VEGOILS-Palm hits four-year high before easing on weaker soyoil 02-Dec-2016 07:02:10 PM * Palm hits intraday high of 3,106 rgt/T * Market down on weak related oils, stronger ringgit - Trader * Signals are mixed for palm oil - Technicals By Emily Chow KUALA LUMPUR, Dec 2 (Reuters) - Malaysian palm futures hit their highest in more than four years on Friday before easing to close in negative territory on weakness in related oils and a stronger ringgit.

2 Dec 2016: Reuters - Palm hits one-week high tracking stronger crude oil, BMD RM3,079 / $690

VEGOILS-Palm hits one-week high tracking stronger crude oil - Reuters News 01-DEC-2016 07:04:43 PM *

Palm is up on stronger crude oil, but gains seen limited - trader *

Palm could see resistance at 3,093 rgt/T - technicals By Emily Chow

28 Nov 2016: Palm up on soy oil and weak Ringgit, EU leaked draft shows 2030 biofuel from food and feed crops cap at 3.8%, but US boosts biofuel quota for 2017 to record level, BMD RM3,031/$680

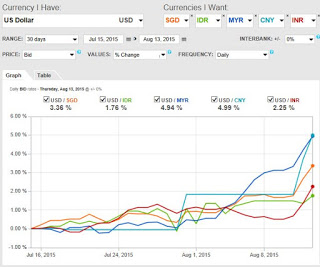

VEGOILS-Palm up nearly 1 pct on weaker ringgit, lower output expectations - Reuters News 25-Nov-2016 06:34:30 PM * Palm futures clocks fifth straight day of gains * Ringgit remains around 14-month low * Palm could rise 10 pct in Q1 2017 - Mistry By Liz Lee KUALA LUMPUR, Nov 25 (Reuters) - Malaysian palm oil futures ended nearly 1 percent higher on Friday, recording a fifth consecutive session of gains due to persistent weakness in the ringgit and falling output...The Malaysian currency fell as much as 0.18 percent to 4.453 against the dollar, almost matching the record low of 4.456 hit on Sept. 29, 2015. The ringgit has shed nearly 6 percent since Donald Trump's victory in the U.S. presidential election on Nov. 8, making it Asia's worst performing currency.

VEGOILS-Palm closes at near two-week high, tracking CBOT soyoil rally - Reuters News 24-NOV-2016 06:30:37 PM *

Palm futures rose for a fourth day *

Palm futures touch highest since September 2012 *

Ringgit hits almost 14-month trough Updates with closing price By Fransiska Nangoy JAKARTA, Nov 24 (Reuters) - Malaysian palm oil futures rose for a fourth day on Thursday after touching a four-year high intraday, as it tracked a rally in soyoil on the Chicago Board of Trade (CBOT) on latest U.S. government biodiesel requirements.

Biodiesel's presence in future EU policy revealed in leaked draft By Ron Kotrba | November 22, 2016 http://www.biodieselmagazine.com/articles/1874430/biodiesels-presence-in-future-eu-policy-revealed-in-leaked-draft

Ambank writes: According to Biodiesel Magazine, a leaked draft of annexes from the European Commission's revised Renewable Energy Directive showed that fuel produced from food or feed crops will have a reduced role in the transportation sector after year 2020. Biofuel from food and feed crops will remain capped at 7% through 2021, after which the cap will be reduced by 0.3% a year through 2025. In 2030, maximum amount of biofuel from food and feed crops will be 3.8%. Over the past couple of years, the EU government has faced pressure from anti-biofuel groups, which said that greenhouse gas emissions from biofuels are worse than those from petroleum fuels.

US boosts biofuel quota for 2017 to record level http://www.bloomberg.com/politics/articles/2016-11-23/u-s-boosts-biofuel-quota-for-2017-to-record-level

21 Nov 2016: Reuters - palm falls on weaker rival oils, China hedge fund and raised margins, cash crunch chokes off India buying, RM2,869 /$649.98 on 18 Nov.

Reuters - VEGOILS-Palm falls for first session in three on weaker rival oils - Reuters News 18-Nov-2016 * Forecasts for higher output in Indonesia weigh on mkt * Palm down 3.5 pct this week * Palm looks neutral in 2,823-2,891 rgt/T range - Techs

AM markets: ags fall, as China takes its turn to hurt prices 14th Nov 2016, by Mike Verdin -- As if the election of Donald Trump as president of the US wasn't enough for investors to get their heads around, the world's second biggest economy, China, is providing cause for jitters in commodity markets too. Talk that was around late last week – of a hedge fund blowing up, and of raised margins for investors trading on Chinese commodity exchanges – remained live on Monday. http://www.agrimoney.com/marketreport/am-markets-ags-fall-as-china-takes-its-turn-to-hurt-prices--3845.html

Cash crunch chokes off India palm oil imports By Reuters | Updated: Nov 18, 2016 -- India's palm oil imports are expected to slip next month by up to a fifth, including from the top two producers Indonesia and Malaysia, as New Delhi's removal of high-value rupee notes from circulation disrupts distribution systems and curbs demand. Traders in Malaysia, India's largest palm oil supplier taking up half of its imports last year, say the absence of the large bills has already impacted sales. Indian buyers are delaying shipments and cancelling vessel space bookings, and .. http://economictimes.indiatimes.com/articleshow/55494139.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Exclusive: KL palm oil futures sentiment dampened as China curbs speculation BY OOI TEE CHING - 14 NOVEMBER 2016 -- "Today, the olein futures at the Dalian Commodity Exchange saw limit down when prices plunged by more than 5 per cent," Nandha added. Last week, it was reported that the China Securities Regulatory Commission banned futures brokers there from providing margin financing, so as to cool down the overheated financial markets. Read More : http://www.nst.com.my/news/2016/11/188695/exclusive-kl-palm-oil-futures-sentiment-dampened-china-curbs-speculation

Myth of excessive edible oil imports G CHANDRASHEKHAR November 10, 2016; Trade bodies must stop extracting State favours in the name of protecting farmers -- How valid is the assertion that ‘excessive’ quantities are being imported and whether the recommendation of a duty hike has merit?... India’s oil year runs from November to October. During the current oil year (November 2015 to October 2016), India imported 13.4 million tonne till September 2016, of which the share of palm oil (both crude and refined) was 7.7 million tonne.... While total import (covering all oils) has increased from 12.8 million tonne in the first 11 months of 2014-15 to 13.4 million tonne in the corresponding period this year, the share of palm oil has actually declined from 66 per cent in the previous year (8.4 million tonne) to 57 per cent in the current year. Palm oil has been substituted by higher import of soyabean oil....The apex body, Central Organisation for Oil Industry and Trade (COOIT), has estimated domestic production in 2015-16 at 7.2 million tonne, unchanged from the previous year..... http://www.thehindubusinessline.com/opinion/edible-oil-imports-to-india/article9330244.ece

3 Nov 2016: Reuters - Palm rises on concerns about lower output, BMD RM2,758 / $659

Editor's note: From recent industry conference discussions, the issue of palm market share dips in China and India. Also refer to Palm Oil Analytics graphic below.

VEGOILS-Palm rises on concerns about lower output - Reuters News 02-Nov-2016 07:38:42 PM -- *Palm sees first gain after two losing sessions *Up on concerns of lower production, weaker ringgit *Government data scheduled for release on Nov. 10 By Emily Chow

Oil Falls on ‘Most Bearish Report of All Time’ Crude-oil inventory surges the most in 34 years of data, extending selloff By TIMOTHY PUKO Nov. 2, 2016 -- The supply data prompted investors to reduce expectations that two years of oversupply in the oil markets is coming to an end. U.S. prices immediately shed nearly $1 a barrel and losses spread into gasoline and diesel futures. http://www.wsj.com/articles/oil-prices-slip-as-production-deal-prospects-fade-1478085559?

Note:

Brent crude (ICE) $47.31.

source: http://www.palmoilanalytics.com/

26 Oct 2016: Palm oil futures reversed gains from the more than two-year high reached the previous day, BMD RM2,760 / $664

VEGOILS-Palm drops on amended industry data, stronger ringgit - Reuters News 25-Oct-2016 07:19:50 PM *Palm tumbles on amended output data, lower exports *Stronger ringgit also dragged sentiment *Further market correction likely By Liz Lee -- Malaysian palm oil futures reversed gains from the more than two-year high reached the previous day, as the market reacted to revised industry data and a strengthening ringgit on Tuesday. A trader based in Kuala Lumpur noted that the market had been driven by the data received over the two days, as well as the strengthening ringgit. "The amendment to the Malaysia Palm Oil Association output data, from a 11 percent decline announced yesterday to 3.9 percent increase amended today, has significantly impacted the market. People took the numbers seriously," he said.

24 Oct 2016: Reuters - Palm closes the week higher as low stocks hold market, BMD RM 2,724 / $651

Editor's note: The palm oil producers are mulling the EFSA process contaminants issue. It's worth reading up on it.

VEGOILS-Palm closes the week higher as low stocks hold market - Reuters News 21-Oct-2016 08:28:02 PM *Palm closes higher, as traders take position for the weekend *Prices gain for second consecutive week By Emily Chow and Liz Lee - Malaysian palm oil closed higher on Friday, reversing earlier losses, as traders squared positions ahead of the weekend and as low stock levels supported the market. Benchmark palm oil futures for January 1FCPOc3 on the Bursa Malaysia Derivatives Exchange rose 0.2 percent to 2,724 ringgit ($651.21) a tonne. They had dropped earlier to a three-week low.

Fratini Vergano Trade Prespectives Issue No. 19 of 21 October 2016: EFSA’s opinion on certain process contaminants in refined vegetable oils – explaining an oversimplified issue

....Following a request of the Commission in July 2014, the Panel on Contaminants in the Food Chain of the European Food Safety Authority (hereinafter, EFSA) delivered on 3 May 2016 a scientific opinion on the risks for human health related to the presence of the process contaminants 3- and 2-monochloropropanediol (hereinafter, MCPD), and their fatty acid esters, and glycidyl fatty acid esters (hereinafter, GE) in processed vegetable oils. Following the publication of the opinion on certain process contaminants in food, there were reports highlighting, in an oversimplified and deceptive manner, that, inter alia, palm oil causes cancer. This article aims at clarifying the real meaning of the EFSA opinion on the matter......

22 Oct 2016: Indonesia CPO export tax affirmed zero for November? Malaysia cooking oil revamp to limit abuses?

Editor's note: I got a message on

Indonesia CPO export tax affirmed zero for November.

See last week's story on expectation. Discussions on this issue in KL too. Also, please also note more global consumer goods manufacturers are committing to reduce saturated fats use - usually negative for their palm oil usage. See PepsiCo news below and more here, http://khorreports-palmoil.blogspot.my/p/khor-reports-food-watch.html

Indonesia likely to keep palm export tax at zero for Nov -industry Oct 14, 2014 -- In an attempt to give the market a boost, the world's No.2 palm oil producer, Malaysia, exempted the commodity from export taxes from September until the end of December. ... Indonesia followed by slashing its monthly CPO export tax to zero for October from 9 percent in September and this is now likely to be extended into November http://www.reuters.com/article/indonesia-palmoil-tax-idUSL3N0S93KV20141014

What’s really cooking with edible oil? BY M. SHANMUGAM 22 October 2016 -- CONFUSION reigns in the cooking oil subsidy controversy. The initial news that came out was that the Government would cut subsidies for cooking oil, something that producers say will result in higher prices of essential items. -- Under the quota system, the subsidised price threshold is set at about RM1,900 per tonne of edible oil. What it means is that the re-packer can purchase up to the quota allocated at RM1,900 per tonne, with the rest of their requirements having to be purchased at market price....Seeing how the supply chain of cooking oil works, any adjustments to the quota system will impact the re-packers. Hence, their protest from the association and threats that the price of cooking oil will go up if there are adjustments to the quota. Based on financials, the bigger the quota, the better it is for re-packers because it ensures that the margins for a larger portion of their products are protected.... However, at the heart of the matter is whether the quota allocated to re-packers is more than what is required for domestic consumption... Has this led to some players in the industry taking advantage of the quota system to export cooking oil purchased at lower than market prices from refiners, thanks to the Government subsidy scheme? The statement from Johari seems to be hinting at that. He had said that cooking oil would continue to be subsidised and what the Government wants to do is to ensure that the subsidised oil is not exported... And of course, when the quota is adjusted downwards, the Government saves some money as the subsidy bill is lower. Nevertheless, a blanket subsidy is always bad.... Measures such as an increase in the payouts of Bantuan Rakyat 1Malaysia and a reduction in the personal income tax would certainly be the preferred mode instead of a subsidy system that is subject to abuse. http://www.thestar.com.my/business/business-news/2016/10/22/whats-really-cooking-with-edible-oil/

According to PepsiCo, at least two-thirds of the company's beverages will contain 100 calories or less per 12-ounce serving by 2025.... Also, at least three-quarters of the foods will not exceed 1.1 grams of saturated fat per 100 calories.... According to the CEO, the company also already made significant strides and is now frying snacks in many countries using "heart-healthy oil." Also, she said in China the company has available to it a new frying technique that can reduce saturated fat levels by about 20 percent while at the same time increasing capacity of the machines by 25 percent....http://www.cnbc.com/2016/10/14/pepsico-pledges-to-slash-beverage-calorie-counts-by-2025.html

21 Oct 2016: MPOC POTS KL price views, Indonesia CPO Fund outlook, China clampdown on commodity trading, Colombia seeks to tie biofuels to fossil fuel prices, BMD RM 2,718 / $650

Editor's note: At last week's MPOC POTS KL conference the triumvirate of palm price prognostication diverged in viewpoints. There was discussion of production drop due to El Nino and when production is expected to return. Worries arise on exports. Soon afterwards, news on China clamp down affecting commodity trading.

VEGOILS-Palm oil declines on slowing exports, weaker Dalian gains - Reuters News 20-Oct-2016 07:12:39 PM *Palm declines after gains in early trade *Market declines as Dalian comes off, and on weaker export data - Trader By Emily Chow

KUALA LUMPUR, Oct 20 (Reuters) - Malaysian palm oil gave up its early gains on Thursday, declining towards the end of the trading day as rallies of rival vegetable oils on China's Dalian Commodity Exchange slowed and palm export demand weakened.

Colombia - Government freezes biofuel prices Published: 20 October 2016 10:33 AM The government has permanently fixed the price of fuel ethanol and biodiesel in Resolution 40953. From October 6 onwards the price for fuel ethanol will be COP7,832.84 ($1=2,913) per litres and for biodiesel COP9,966.02. This brings ethanol in line with gasoline. The move has caused an outcry in the industry which said that this would put the $3 bln investment in the sector at risk.

Indonesia raises 2017 biodiesel subsidy fund target on export gain - Reuters News 19-OCT-2016 02:55:37 PM By Emily Chow KUALA LUMPUR, Oct 19 (Reuters) - Indonesia has raised its target for funds collection in 2017 for its biodiesel subsidy programme by nearly 14 percent from this year on the expectation of higher palm oil exports, the head of the programme operator said on Wednesday...Krisnamurthi estimated that the target collection for the subsidy fund next year is 10.7 to 10.8 trillion rupiah ($830 million). The 2016 target is 9.5 trillion rupiah.... Indonesia started collecting a levy on its palm oil exports last July - $50 per tonne for crude palm oil and $30 for processed palm oil products - and uses part of it to help fund its biodiesel subsidies.

China's risk clamp down hits commodity trades, niche broker business 17-OCT-2016 07:00:49 AM

• China asset management regulator tightens rules on risk • Aimed at asset managers of financial firms, futures brokers • Prompts slump in structured product sales by brokers • In turn, sales slump hits commodities futures volumes • By Ruby Lian and Engen Tham

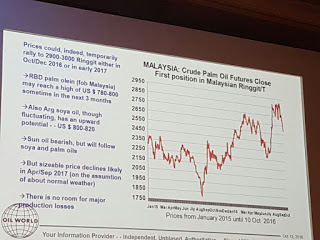

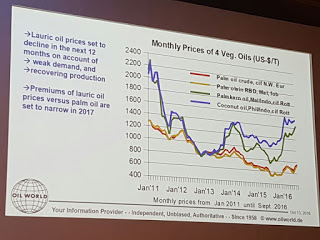

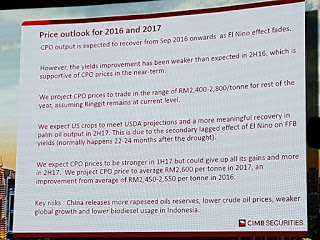

At MPOC POTS KL conference, slides referring to price from Thomas Mielke of Oil World (top two), Ivy Ng of CIMB Securities, Dorab Mistry of Godrej and James Fry of LMC International

26 Sep 2016: India cuts import duties, FFB yield recover to come, 23 Sept RM2,675 /US$651

India has cut the import duties for crude palm oil from 12.5% to 7.5% and refined palm oil from 20% to 15%.

VEGOILS-Palm falls on lower demand, profit-taking - Reuters News 23-Sep-2016 06:50:21 PM -- *Palm up 3.1 pct this week, best weekly gain in six *Market sees lower production, demand to year-end: trader By Emily Chow

UOBKH Research - Plantation: The earliest we can see full FFB yield recovery is by early-4Q17, as the impact from El Nino is still ongoing. 2017 Malaysian production is expected to be slightly better than 2016.

23 Sep 2016: China favours Canada commodities to continue. Australia misses chance as does palm oil? China-Canada bilateral agreements cover canola and beef

China agrees to maintain Canada's access to $2B canola market through 2020, By Janyce McGregor, CBC News Posted: Sep 22, 2016 --

.... .... The canola compromise was reached at the last minute during talks between Chinese Premier Li Keqiang and Prime Minister Justin Trudeau on Parliament Hill Thursday. Li is on a four-day official visit to Canada. Intense negotiations went overnight between Canadian officials and Zhi Shuping, the Chinese minister responsible for

the canola file who's also in Ottawa for the visit... THe current worldwide surplus of the oilseed led China to put pressure on international producers. China could have cut out or cut back on Canada's shipments in favour of another country like Australia...In this compromise, both sides agreed to conduct additional scientific research to find a "sciencebased and stable solution," Trudeau said..... The beef deal — to resume trade in bone-in beef cuts from cattle under 30 months of age — was among a collection of bilateral agreements signed Thursday on a range of trade and security issues....

http://www.cbc.ca/…/poli…/canada-china-beef-canola-1.3773980

21 Sept 2016: Supplies tighten and palm oil price lifted, Malaysia considering double-deduction for sustainability and suggestion for harmonised duties with Indonesia

AmBank email report 21 Sep 2016: The Edge Daily reported that the government is considering tax suggestions from plantation companies including a double deduction for companies that promote sustainability. The government is also evaluating suggestions on the tax policy and duty structure of CPO. It was proposed that the export duties for CPO in Malaysia and Indonesia be harmonised through the Council of Palm Oil Producer Countries framework.

VEGOILS-Palm oil hits five-month high as supplies tighten - Reuters News 20-Sep-2016 07:07:59 PM -- *Palm hits intraday and five month high of 2,725 rgt/T *Tight supplies, stronger soy lifted the market - trader *Palm seen rising to 2,761 rgt/T - technicals By Emily Chow

5 Sept 2016: Malaysia palm oil stocks tight on rising demand

From CIMB Research this morning

■ Malaysia’s palm oil stocks may have fallen by 18% mom to 1.45m tonnes at end-Aug.

■ The CIMB Futures survey revealed that Aug CPO output rose by 5.4% mom to 1.67m tonnes .

■ This is not sufficient to cater for the strong 26.9% mom rise in exports in Aug

■ The short supply resulted in CPO prices rallying to a new high of RM2,845 per tonne

VEGOILS-Palm rises most in over two weeks on ringgit, rival oils - Reuters News 02-Sep-2016 06:51:04 PM *Palm rises most since Aug. 17 *Boosted by weaker ringgit, better-performing Dalian - trader *Palm to test 2,578 rgt/T - technicals By Emily Chow

Indonesia environment team threatened with death investigating haze Sep 5, 2016 -- By Bernadette Christina Munthe | JAKARTA