1 Dec 2017: US net oil imports lowest since 1990, Saudi 'goosing' oil prices? China's lending crackdown, Brent Crude (ICE) $63.07

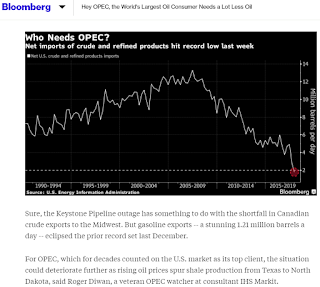

Hey OPEC, the World's Largest Oil Consumer Needs a Lot Less Oil By Laura Blewitt and Javier Blas November 30, 2017 -- U.S. net oil imports, including crude and refined products, last week dropped to just 1.77 million barrels a day, the lowest level in data going back to 1990, the U.S. Energy Information Administration reported Wednesday. That puts the country on track toward its lowest monthly imports since before the Arab oil embargo of 1973. Weekly net imports peaked in November 2005 at more than 14 million barrels a day.

https://www.bloomberg.com/news/articles/2017-11-29/hey-opec-the-world-s-largest-oil-consumer-needs-a-lot-less-oil

Aramco IPO: The Right Company At The Wrong Time Nov.13.17 by Albert Goldson -- An Aramco IPO represents a political tripwire endangering Saudi sovereignty over their oil resources. Crown Prince Mohammed bin Salman’s internal crackdown consolidates his power and gives him an open road to his ascendency as Saudi king before the November 30th OPEC meeting. Saudi Arabia’s deliberate inflammatory spat with Iran is misdirection from their internal political shakeup that is simultaneously ‘goosing’ oil prices to their benefit. https://seekingalpha.com/article/4124280-aramco-ipo-right-company-wrong-time

China's Lending Crackdown Is Notable for Three Reasons. The platforms have mushroomed from fewer than 10 to more than 2,000, but only a few hundred operate with government-issued permits, By Junheng Li November 30, 2017.... Although the measures haven't been made public, our industry checks suggest three notable changes. First, the issuance of new licenses to online micro-loan platforms is being suspended, suggesting that regulators are scrutinizing online lending practices. Second, banks and bank-holding companies are being told not to buy loans underwritten by online platforms because such assets are deemed too risky. Third, turning the loans into securities will be forbidden because regulators believe securitization amplifies risks and gives investors less of an incentive to perform due diligence on the underlying assets. https://www.bloomberg.com/view/articles/2017-11-30/china-s-lending-crackdown-is-notable-for-three-reasons

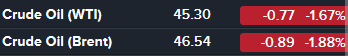

15 Jun 2017: Oil traders talk of a buyer’s market for light-sweet crude, China targets financial risk, lack of new safe-haven assets, Singapore feud, Exxon and climate change, Brent Crude (ICE) $46.95

Fed Lifts Rates, Sets Out Plan to Shrink Assets - The Federal Reserve said it would raise short-term interest rates and spelled out in greater detail its plans to start slowly shrinking its $4.5 trillion portfolio of bonds and other assets this year http://www.wsj.com/livecoverage/federal-reserve-june-meeting

Anbang Shows Billionaires Should Be Nervous in Xi's New China by Keith Zhai and Ting Shi June 14, 2017 -- Insurance giant’s chairman mysteriously absent from company, Xi targets financial risk, asserts power before party congress https://www.bloomberg.com/politics/articles/2017-06-14/anbang-shows-billionaires-should-be-nervous-in-xi-s-new-china

SIBLINGS OF SINGAPORE PM FEAR FOR THEIR SAFETY, ACCUSING HIM OF HARASSMENT AND TRASHING LEE KUAN YEW’S VALUES - ‘We feel big brother omnipresent. We fear the use of the organs of state against us’ BY BHAVAN JAIPRAGAS 14 JUN 2017 http://www.scmp.com/week-asia/politics/article/2098224/siblings-singapore-pm-fear-their-safety-accusing-him-harassment

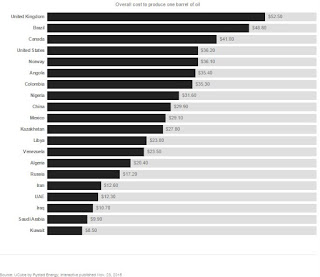

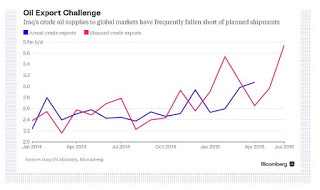

The Lonely Drifting Oil Tanker That Signals OPEC's Struggle by Laura Hurst and Javier Blas June 13, 2017, 7:57 PM GMT+8 June 14, 2017, 1:36 AM GMT+8 -- Atlantic oil market oversupplied on Nigeria, Libya production. Oil traders talk of a buyer’s market for light, sweet crude... https://www.bloomberg.com/news/articles/2017-06-13/the-lonely-drifting-oil-tanker-that-signals-opec-s-struggle

Gasoline’s Unusual Summer Stockpile Surge Weighs on Oil By Laura Blewitt June 15, 2017 -- Gasoline inventories are moving in the wrong direction this summer, rising the most in the first two weeks of June since 2001. The U.S. is hoarding more than 242 million barrels of gasoline, the highest for this time of year in weekly data going back to 1990. The surge in stockpiles sent gasoline futures on the New York Mercantile Exchange plunging to the lowest since late November at $1.4294 a gallon and pulled crude oil below $45 a barrel.—With Michael Roschnotti https://www.bloomberg.com/news/articles/2017-06-14/gasoline-s-unusual-summer-stockpile-surge-weighs-on-oil

The Global Economy Is Rebounding, But There’s One Big Problem by Chris Anstey and Enda Curran June 14, 2017, 12:01 AM GMT+8 June 14, 2017, 2:26 PM GMT+8

There’s a dark cloud building behind the world’s best period of synchronous growth among developed and emerging economies this decade -- one that in time could rain down volatility in global markets... The problem, identified by strategist and hedge fund manager Stephen Jen, is a deepening imbalance in the lack of new safe-haven assets as the world’s output expands. https://www.bloomberg.com/news/articles/2017-06-13/synchronous-global-recovery-masks-a-deepening-asset-imbalance

Shareholders force ExxonMobil to come clean on cost of climate change: The ExxonMobil resolution, introduced by the New York State Common Retirement Fund, says that the company “should analyze the impacts on ExxonMobil’s oil and gas reserves and resources under a scenario in which reduction in demand results from carbon restrictions and related rules or commitments adopted by governments consistent with the globally agreed upon 2 degree [Celsius] target”. The resolution adds: “This reporting should assess the resilience of the company’s full portfolio of reserves and resources through 2040 and beyond, and address the financial risks associated with such a scenario.”

https://www.theguardian.com/business/2017/may/31/exxonmobil-climate-change-cost-shareholders

13 Feb 2017: Asia's potential trade hot spots, India oil demand plunges on cash ban

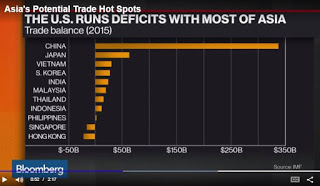

Asia's Potential Trade Hot Spots February 13, 2017 -- Most of Asia has largely escaped President Trump's glare on trade, but he may yet come looking. The U.S. runs trade deficits with many of its partners in the region. Bloomberg's Haslinda Amin reports on "Bloomberg Markets." (Source: Bloomberg)

https://www.bloomberg.com/news/videos/2017-02-13/asia-s-potential-trade-hot-spots

These Countries Could Be Trump's Next Trade War Targets by David Tweed -- U.S. has trade deficits with most Asian trade partners. Vietnam surplus with U.S. represents 15% of the economy...https://www.bloomberg.com/politics/articles/2017-02-12/asia-s-potential-trade-hot-spots-escaping-trump-s-glare-for-now

China Ready to Step Up Scrutiny of U.S. Firms If Trump Starts Feud: Sources by Bloomberg News January 6, 2017 -- Options include antitrust, tax probes of American companies. Tension has been building in run-up to Trump’s inauguration https://www.bloomberg.com/politics/articles/2017-01-06/china-said-to-mull-scrutiny-of-u-s-firms-if-trump-starts-feud-ixl2je3s

These Countries Could Be Trump's Next Trade War Targets by David Tweed -- U.S. has trade deficits with most Asian trade partners. Vietnam surplus with U.S. represents 15% of the economy...https://www.bloomberg.com/politics/articles/2017-02-12/asia-s-potential-trade-hot-spots-escaping-trump-s-glare-for-now

India’s Oil Demand Plunges Most in 13 Years Amid Cash Ban by Saket Sundria February 13, 2017 https://www.bloomberg.com/news/articles/2017-02-13/india-s-oil-demand-plunges-most-in-13-years-amid-cash-crackdown

12 Feb 2017: China - Companies asked to estimate highest duties they can bear for punitive US tariffs; Malaysia-Thailand have significant good trade surplus with US

Editor's note: Malaysia and Thailand have significant surplus in trade with US; with each of these two, US faces deficits that are 1/3 of the goods trade deficit that it has with Mexico. From US Census Bureau, ''trade in goods" data: US-Singapore in surplus $8-12b, US deficit trade partners: US-Indonesia $12b, US-Thai $19b, US-Malaysia $22b, US-Mexico $63b, US-EU $130b, US-China $300-360b.

China Said to Assess Impact of Possible Punitive U.S. Tariffs by Bloomberg News February 10, 2017 -- Companies asked to estimate highest duties they can bear, Donald Trump has accused China of unfair trade practices -- https://www.bloomberg.com/news/articles/2017-02-10/china-said-to-assess-impact-of-possible-punitive-u-s-tariffs

Trump Holds Call With China's XI, Honors One-China Policy February 10, 2017 -- President Donald Trump reaffirmed the U.S.'s long-standing support for the "One-China" policy in his first phone call as president with Chinese counterpart Xi Jinping. Bloomberg's David Tweed reports on "Bloomberg Daybreak: Europe." (Source: Bloomberg) https://www.bloomberg.com/news/videos/2017-02-10/trump-holds-first-call-with-china-s-xi

OPEC's Amazing and Shortlived Compliance By Julian Lee Feb 12, 2017 -- At 90 percent, it looks like January may be as good as it gets for compliance. We may have another month or so before Saudi Arabia needs to choose between cutting exports or boosting supply, but it is difficult to see overall adherence getting much better without involuntary cuts somewhere due to accident or unrest. https://www.bloomberg.com/gadfly/articles/2017-02-12/don-t-get-used-to-the-amazing-cuts-in-opec-oil-production

How Singapore plans growth in dark globalization mood - https://www.bloomberg.com/news/videos/2017-02-10/how-singapore-plans-growth-on-dark-globalization-mood

China Said to Assess Impact of Possible Punitive U.S. Tariffs by Bloomberg News February 10, 2017 -- Companies asked to estimate highest duties they can bear, Donald Trump has accused China of unfair trade practices -- https://www.bloomberg.com/news/articles/2017-02-10/china-said-to-assess-impact-of-possible-punitive-u-s-tariffs

Trump Holds Call With China's XI, Honors One-China Policy February 10, 2017 -- President Donald Trump reaffirmed the U.S.'s long-standing support for the "One-China" policy in his first phone call as president with Chinese counterpart Xi Jinping. Bloomberg's David Tweed reports on "Bloomberg Daybreak: Europe." (Source: Bloomberg) https://www.bloomberg.com/news/videos/2017-02-10/trump-holds-first-call-with-china-s-xi

OPEC's Amazing and Shortlived Compliance By Julian Lee Feb 12, 2017 -- At 90 percent, it looks like January may be as good as it gets for compliance. We may have another month or so before Saudi Arabia needs to choose between cutting exports or boosting supply, but it is difficult to see overall adherence getting much better without involuntary cuts somewhere due to accident or unrest. https://www.bloomberg.com/gadfly/articles/2017-02-12/don-t-get-used-to-the-amazing-cuts-in-opec-oil-production

How Singapore plans growth in dark globalization mood - https://www.bloomberg.com/news/videos/2017-02-10/how-singapore-plans-growth-on-dark-globalization-mood

Trump Holds Call With China's XI, Honors One-China Policy February 10, 2017 -- President Donald Trump reaffirmed the U.S.'s long-standing support for the "One-China" policy in his first phone call as president with Chinese counterpart Xi Jinping. Bloomberg's David Tweed reports on "Bloomberg Daybreak: Europe." (Source: Bloomberg) https://www.bloomberg.com/news/videos/2017-02-10/trump-holds-first-call-with-china-s-xi

OPEC's Amazing and Shortlived Compliance By Julian Lee Feb 12, 2017 -- At 90 percent, it looks like January may be as good as it gets for compliance. We may have another month or so before Saudi Arabia needs to choose between cutting exports or boosting supply, but it is difficult to see overall adherence getting much better without involuntary cuts somewhere due to accident or unrest. https://www.bloomberg.com/gadfly/articles/2017-02-12/don-t-get-used-to-the-amazing-cuts-in-opec-oil-production

How Singapore plans growth in dark globalization mood - https://www.bloomberg.com/news/videos/2017-02-10/how-singapore-plans-growth-on-dark-globalization-mood

26 Jan 2017: Trump Has 1.3 Billion Reasons Not to Pick a Big Fight With China Malaysia-China trade likely to rise to US$100b, China overtakes Japan in Indonesia direct investment, Brent Crude $55.40

Trump Has 1.3 Billion Reasons Not to Pick a Big Fight With China by Bloomberg News January 26, 2017 - Xi has little room to make concessions before party congress, China leaders already fanning national pride, stressing unity https://www.bloomberg.com/politics/articles/2017-01-25/trump-has-1-3-billion-reasons-not-to-pick-a-big-fight-with-china

Minister: Malaysia-China trade likely to rise to US$100b this year anuary 23, 2017 - See more at: http://www.themalaymailonline.com/malaysia/article/minister-malaysia-china-trade-likely-to-rise-to-us100b-this-year#sthash.jZqdad0v.dpuf

Hishammuddin: Malacca port not Chinese military naval base January 25, 2017 - See more at: http://www.themalaymailonline.com/malaysia/article/hishammuddin-malacca-port-not-chinese-military-naval-base#sthash.KMKp19JH.dpuf

China overtakes Japan in Indonesia direct investment - Chinese money flowing into the country grew fivefold from a year ago by WATARU SUZUKI and ERWIDA MAULIA, Nikkei staff writers January 25, 2017; http://asia.nikkei.com/Politics-Economy/International-Relations/China-overtakes-Japan-in-Indonesia-direct-investment

Chinese billionaire Jack Ma says the US wasted trillions on warfare instead of investing in infrastructure by Jay Yarow 18 Jan 2017 -- Ma called outsourcing a "wonderful" and "perfect" strategy... "The American multinational companies made millions and millions of dollars from globalization," Ma said. "The past 30 years, IBM, Cisco, Microsoft, they've made tens of millions — the profits they've made are much more than the four Chinese banks put together. ... But where did the money go?" ... He said the U.S. is not distributing, or investing, its money properly, and that's why many people in the country feel wracked with economic anxiety. He said too much money flows to Wall Street and Silicon Valley. Instead, the country should be helping the Midwest, and Americans "not good in schooling," too.... http://www.cnbc.com/2017/01/18/chinese-billionaire-jack-ma-says-the-us-wasted-trillions-on-warfare-instead-of-investing-in-infrastructure.html

China’s Debt-Trap Diplomacy JAN 23, 2017 13 by BRAHMA CHELLANEY -- Of course, extending loans for infrastructure projects is not inherently bad. But the projects that China is supporting are often intended not to support the local economy, but to facilitate Chinese access to natural resources, or to open the market for low-cost and shoddy Chinese goods. In many cases, China even sends its own construction workers, minimizing the number of local jobs that are created.... Several of the projects that have been completed are now bleeding money. For example, Sri Lanka’s Mattala Rajapaksa International Airport, which opened in 2013 near Hambantota, has been dubbed the world’s emptiest. Likewise, Hambantota’s Magampura Mahinda Rajapaksa Port remains largely idle, as does the multibillion-dollar Gwadar port in Pakistan. For China, however, these projects are operating exactly as needed: Chinese attack submarines have twice docked at Sri Lankan ports, and two Chinese warships were recently pressed into service for Gwadar port security. https://www.project-syndicate.org/commentary/china-one-belt-one-road-loans-debt-by-brahma-chellaney-2017-01

21 Jan 2017: Trump’s Tough Talk Further Rattles World Capitals, Full Inaugural Address video, Jack Ma says the US wasted trillions on warfare, China growth slips, U.S. Oil Producers Ramp Up Spending, Brent Crude $55.49

Trump’s Tough Talk Further Rattles World Capitals on Day One by Nick Wadhams and Josh Wingrove January 21, 2017 -- Pledges to ‘reinforce old alliances and form new ones’. Speech fuels concern in world capitals on U.S. leadership https://www.bloomberg.com/politics/articles/2017-01-20/trump-s-tough-talk-further-rattles-global-capitals-on-day-one

President Trump's Full Inaugural Address 1/20/2017 -- President Donald Trump delivered a 16-minute inaugural address on Friday that will be remembered for its populism and defiance. http://www.wsj.com/video/president-trump-full-inaugural-address/5DE6F5D4-6C70-4D7B-9354-F31F9D2CA6C5.html?mod=djemTEW_h

Transcript: President Donald Trump’s 2017 Inaugural Address https://www.bloomberg.com/politics/articles/2017-01-20/full-text-president-donald-trump-s-2017-inaugural-address

Buffett Supports Trump on Cabinet Picks ‘Overwhelmingly’ by Amanda L Gordon and Noah Buhayar https://www.bloomberg.com/news/articles/2017-01-20/buffett-says-he-supports-trump-s-cabinet-picks-overwhelminglyJanuary 20, 2017

Chinese billionaire Jack Ma says the US wasted trillions on warfare instead of investing in infrastructure by Jay Yarow 18 Jan 2017 -- Ma called outsourcing a "wonderful" and "perfect" strategy..."The American multinational companies made millions and millions of dollars from globalization... The past 30 years, IBM, Cisco, Microsoft, they've made tens of millions — the profits they've made are much more than the four Chinese banks put together. ... But where did the money go?" ... He said the U.S. is not distributing, or investing, its money properly, and that's why many people in the country feel wracked with economic anxiety. He said too much money flows to Wall Street and Silicon Valley.. http://www.cnbc.com/2017/01/18/chinese-billionaire-jack-ma-says-the-us-wasted-trillions-on-warfare-instead-of-investing-in-infrastructure.html

Chinese growth slips to slowest pace for 26 years - With fears about the Trump presidency, rising debt levels and an unwinding property boom, the world’s No 2 economy is set for an uncertain 2017 by Katie Allen 20 January 2017 16.04 GMT https://www.theguardian.com/business/2017/jan/20/chinese-economic-growth-dips-to-67-the-slowest-for-26-years

18 Jan 2017: China’s Xi Jinping Seizes Role as Leader on Globalization, Trump favors a weaker dollar.

China’s Xi Jinping Seizes Role as Leader on Globalization, ‘No one will emerge as a winner in a trade war,’ Chinese president says By STEPHEN FIDLER in Davos, Switzerland and TE-PING CHEN and LINGLING WEI in Beijing Jan. 17, 2017... In a keynote address, Chinese President Xi Jinping issued a full-throated defense of international trade and economic integration, portraying Beijing as a benevolent power intent on upholding an international order that has boosted common prosperity. With doubts about the merits of globalization mounting in the U.S. and elsewhere in the West, Mr. Xi’s speech was portrayed by some who saw it as a move to fill a global leadership vacuum. Some in the audience questioned China’s readiness. Mr. Xi, the first Chinese head of state to attend the forum, also offered an implicit rebuke of Mr. Trump, who has threatened to impose tariffs on China. “No one will emerge as a winner in a trade war,” he said. http://www.wsj.com/articles/chinas-xi-jinping-defends-globalization-1484654899?

Dollar Tumbles on Trump Comments - Dollar falls to one-month low after President-elect Donald Trump describes it as ‘too strong’ By CHELSEY DULANEY, IAN TALLEY and IRA IOSEBASHVILI Updated Jan. 17, 2017 -- Mr. Trump said in an interview published Monday that he favors a weaker dollar, breaking with decades of tradition and intensifying investor concern over the new administration’s capacity for surprising policy shifts. Still, with markets improving and a pro-business administration poised to take over in Washington, the mood among global corporate and financial leaders in Davos is upbeat... http://www.wsj.com/articles/trump-comments-send-dollar-reeling-1484666714?

16 Jan 2017: Malaysia (with China) to challenge Singapore on logistics. High level questions on China's impact on Malaysia jobs, land and more amidst general pessimism. Oxfam targets feted billionaires and says to curtail rewards for those at the top.

Editor's note: From talking to Malaysia business stakeholders on China-Malaysia economic ties, I have been hearing for perhaps two years about their hope of China investments helping Malaysia gain market share on Singapore (harking back to the Mahathir vs LKY FDI plays?). In Singapore, there seemed assurance on good relations with China and that interests would prevail rather than contests. In recent weeks, regional news headlines is replete with economic implications arising from China's shifting relations in the region. Notably, SCMP reported on some (unofficial) negative opinions from China on Singapore, and then came the seizure of Singapore military vehicles in transit in HK. See news links below for comments on a potential renewed logistics role tussle.

How will Singapore navigate the choppy regional waters? By The Edge Singapore / theedgemarkets.com.sg | January 13, 2017 http://www.theedgemarkets.com.sg/sg/article/how-will-singapore-navigate-choppy-regional-waters

China projects to hit Singapore BY HO WAH FOON 15 January 2017 -- “This is a dream of a lifetime for Malaysia to eventually stop cargoes transiting through Singapore, with the generous inflow of direct investments and expertise from China now. In 10 years or so, Malaysia can say bye-bye to Singapore,” says a veteran port operator and logistics consultant with experience in Malaysia, Singapore and China.... http://www.thestar.com.my/news/nation/2017/01/15/china-projects-to-hit-singapore-the-giant-republics-aggressive-investments-in-ports-and-rail-links-i/

We are not selling off country to foreigners, says Najib 16 January 2017 -- http://www.thestar.com.my/news/nation/2017/01/16/we-are-not-selling-off-country-to-foreigners-says-najib/

Muhyiddin slammed for China deals remark BY THO XIN YIandGAN PEI LING 11 January 2017 -- MCA president Datuk Seri Liow Tiong Lai slammed Muhyiddin’s claim as ‘illogical’. “It seems that he has changed his mind after shifting his political alliance. “When he was deputy prime minister, he led missions to China to attract Chinese investors to Malaysia.http://www.thestar.com.my/news/nation/2017/01/11/muhyiddin-slammed-for-china-deals-remark-former-dpms-criticisms-not-logical-say-leaders/

Foreign ownership of land, clear policy needed BY SALLEH BUANG - 12 JANUARY 2017 Read More : http://www.nst.com.my/news/2017/01/203696/foreign-ownership-land-clear-policy-needed

DPM: Malaysians have right to assess working visit to China January 15, 2017 -- Zahid discussed the recognition of halal goods in China, especially in Yunnan province, which has great potential for Jakim and the Halal Industry Development Corporation (HDC). He identified problems faced by Yunnan entrepreneurs wanting to export their goods since Malaysia and China have yet to sign a Free Trade Agreement (FTA). On tourism, Zahid said he was waiting for feedback from the Chinese side on what more can be done to draw more tourists from the country to visit Malaysia. Tourist arrivals from China surged following the visa waiver or ENTRY (electronic travel registration) a year ago. ....http://www.themalaymailonline.com/malaysia/article/dpm-malaysians-have-right-to-assess-working-visit-to-china#sthash.uxEykVJ0.dpuf

Malaysians’ views on economy, politics at record lows, FT survey finds January 4, 2017 -- While the rest of Asean is unanimously predicting improvements in both areas, Malaysians responding to FT Confidential Research’s Economic Sentiment and Political Sentiment held opposing views about their own country. “Malaysians were the most pessimistic respondents in the Asean region, being the only ones expecting their domestic political and economic situations to deteriorate over the next two quarters,” FT wrote. ... http://www.themalaymailonline.com/malaysia/article/malaysians-views-on-economy-politics-at-record-lows-ft-survey-finds#sthash.tIgeIm2Q.dpuf

Oxfam targets feted billionaires and says to curtail rewards for those at the top... http://www.scmp.com/news/world/united-states-canada/article/2062441/obscene-these-eight-men-are-rich-half-all-humanity

11 Jan 2017: Big Oil Hits Sweet Spot, Oil Discoveries Seen Recovering After Crashing to 65-Year Low, Chinese Companies Find New Ways to Borrow, Go-Jek, BHP Held Talks With Trump, Brent crude $53.77

Big Oil Hits Sweet Spot as New Projects Reap Rewards of Recovery by Rakteem Katakey January 11, 2017 https://www.bloomberg.com/news/articles/2017-01-11/big-oil-hits-sweet-spot-as-new-projects-reap-rewards-of-recovery

Oil Discoveries Seen Recovering After Crashing to 65-Year Low by Mikael Holter January 10, 2017 Explorers found 3.7 billion barrels in 2016: Wood Mackenzie. Last year will probably be the low point for discoveries... https://www.bloomberg.com/news/articles/2017-01-10/oil-discoveries-seen-recovering-after-crashing-to-65-year-low

Strapped-for-Cash Chinese Companies Find New Ways to Borrow by Bloomberg News January 11, 2017 ABS sales by Chinese companies more than doubled last year. Doubts about ring-fencing of collateral for ABS: Genial Flow. https://www.bloomberg.com/news/articles/2017-01-10/china-inc-turns-to-structured-debt-for-cash-as-funding-squeezed

Indonesia’s First Billion-Dollar Startup Races to Kill Cash by Yoolim Lee January 11, 2017 https://www.bloomberg.com/news/articles/2017-01-10/indonesia-s-first-billion-dollar-startup-races-to-kill-cash

Uber Problem. Go-Jek Solution By Tim Culpan Jan 10, 2017 -- For sure, the Indonesian unicorn is entering a crowded and competitive market where Grab Taxi, Lippo Group and Ascend Money are vying for the same mobile-payments business. I'm not even convinced that Go-Pay will be the leading player, but it doesn't have to be. All Go-Pay has to do is make life easier for Go-Jek customers and service providers and not lose money (easier said than done). https://www.bloomberg.com/gadfly/articles/2017-01-11/uber-problem-go-jek-solution

BHP Held Talks With Trump Amid China Tariff, Climate Concerns by David Stringer January 11, 2017 -- BHP CEO, chairman met with president-elect in New York. Trump’s infrastructure pledges seen as positive for demand... Trump’s signals that he could spend as much as $500 billion to rebuild U.S. infrastructure lifted metals and producers in the wake of his election, promising to bolster global demand and add to a commodities price revival driven in 2016 by stimulus in China. The Bloomberg World Mining Index has advanced about 4 percent since Trump’s victory in November, while the London Metal Exchange Index of six key metals jumped about 6 percent.... https://www.bloomberg.com/news/articles/2017-01-10/bhp-held-talks-with-trump-amid-china-tariff-climate-concerns

5 Jan 2017: Gloom on Malaysian Ringgit and Singapore seeks new growth, economic forecasters on 2017, bond market outlooks, read Stiglitz, Brent Crude $56.26

Things Will Get Worse for the Malaysian Ringgit: BMI Research by Will Davies January 5, 2017 https://www.bloomberg.com/news/articles/2017-01-04/things-will-get-worse-for-the-malaysian-ringgit-bmi-researchSingapore to Deliver New Growth Map With Economy Under Strain by David Roman January 5, 2017 https://www.bloomberg.com/news/articles/2017-01-04/singapore-to-deliver-new-growth-map-with-economy-under-strain

Best Economic Forecasters Lay Out 2017 Calls - Our most-accurate predictors of inflation, unemployment and growth explain their outlook for this year by Jeanna Smialek January 4, 2017 https://www.bloomberg.com/news/articles/2017-01-04/best-economic-forecasters-lay-out-2017-calls

The 2017 Bond Strategy Backed By Goldman and BlackRock by Brian Chappatta and John Gittelsohn January 4, 2017 https://www.bloomberg.com/news/articles/2017-01-03/the-2017-bond-strategy-that-goldman-blackrock-and-tcw-all-back

Goldman Confronts Protesters Inside New York Headquarters by Dakin Campbell January 5, 2017 https://www.bloomberg.com/news/articles/2017-01-04/goldman-sachs-confronts-protesters-inside-new-york-headquarters

Harvard Academic Sees Debt Rout Worse Than 1994 ‘Bond Massacre’ by Anchalee Worrachate January 4, 2017 https://www.bloomberg.com/news/articles/2017-01-04/harvard-academic-sees-debt-rout-worse-than-1994-bond-massacre

Joseph Stiglitz | The age of Donald Trump: On 20 January 2017, Donald Trump will be inaugurated as the 45th President of the United States. I would hate to say “I told you so,” but his election should not have come as a surprise. As I explained in my 2002 book Globalization and its Discontents, the policies we have used to manage globalization have sown the seeds of widespread disaffection....Of course, there is no going back. China and India are now integrated into the global economy, and technological innovation is reducing the number of manufacturing jobs worldwide. Trump cannot recreate the well-paying manufacturing jobs of past decades; he can only push for advanced manufacturing, which requires higher skill sets and employs fewer people.....Rising inequality, meanwhile, will continue to contribute to widespread despair, especially among the white voters in Middle America who handed Trump his victory. As the economists Anne Case and Angus Deaton showed in their study published in December 2015, life expectancy among middle-age white Americans is declining, as rates of suicides, drug use, and alcoholism increase. A year later, the National Center for Health Statistics reported that life expectancy for the country as a whole has declined for the first time in more than 20 years...In the first three years of the so-called recovery after the 2008 financial crisis, 91% of the gains went to the top 1% of earners......Obama brought “change you can believe in” on certain issues, such as climate policy; but with respect to the economy, he bolstered the status quo—the 30-year experiment with neoliberalism, which promised that the benefits of globalization and liberalization would “trickle down” to everyone. Instead, the benefits trickled up, partly owing to a political system that now seems to be based on the principle of “one dollar, one vote,” rather than “one person, one vote.”.... http://www.livemint.com/Opinion/mssPFfoIzskf8gQCuRrSIO/Joseph%ADStiglitz%AD%ADThe%ADage%ADof%ADDonald%ADTrump.html

4 Jan 2017: China credit worries, HSR, China Railway to European cities, Trump picks import-curbing trade negotiator, will solar get cheaper than coal? Brent Crude $55.47

Can China Connect the World by High-Speed Rail? | Gerald Chan | TEDxKFAS https://www.youtube.com/watch?v=uRdQ_2sjF2s&feature=youtu.be

China’s Credit Engine Is Running Out of Gas by Bloomberg News January 4, 2017 -- President Xi Jinping and his top economic lieutenants last month pledged prudent and neutral monetary policy and proactive fiscal support for 2017 along with sharper focus on avoiding financial risks and asset bubbles. Meanwhile, the PBOC has been allowing a steady increase in money-market rates to squeeze leverage in the bond market, prompting firms to cancel or postpone bond selling of more than 100 billion yuan ($14 billion). ... https://www.bloomberg.com/news/articles/2017-01-03/china-s-credit-engine-is-running-out-of-gas-as-debt-risk-rises

Stratfor - A Problem China Cannot Outgrow by Analysis DECEMBER 29, 2016 Beijing appears to be on the verge of making a difficult choice: Sacrifice growth (and by extension, political support) to tackle Chinese debt head-on, or risk suffering the same debt-driven banking crisis seen in so many countries. https://www.stratfor.com/analysis/problem-china-cannot-outgrow?id=be1ddd5371&uuid=c31b4d91-710b-4276-97ec-534f851eb1d9

'China freight train' in first trip to Barking 3 January 2017 -- China Railway already runs services between China and other European cities, including Madrid and Hamburg. The train will take about two weeks to cover the 12,000 mile journey and is carrying a cargo of clothes, bags and other household items. It has the advantage of being cheaper than air freight and faster than sea. http://www.bbc.com/news/business-38497997China’s Credit Engine Is Running Out of Gas by Bloomberg News January 4, 2017 -- President Xi Jinping and his top economic lieutenants last month pledged prudent and neutral monetary policy and proactive fiscal support for 2017 along with sharper focus on avoiding financial risks and asset bubbles. Meanwhile, the PBOC has been allowing a steady increase in money-market rates to squeeze leverage in the bond market, prompting firms to cancel or postpone bond selling of more than 100 billion yuan ($14 billion). ... https://www.bloomberg.com/news/articles/2017-01-03/china-s-credit-engine-is-running-out-of-gas-as-debt-risk-rises

Stratfor - A Problem China Cannot Outgrow by Analysis DECEMBER 29, 2016 Beijing appears to be on the verge of making a difficult choice: Sacrifice growth (and by extension, political support) to tackle Chinese debt head-on, or risk suffering the same debt-driven banking crisis seen in so many countries. https://www.stratfor.com/analysis/problem-china-cannot-outgrow?id=be1ddd5371&uuid=c31b4d91-710b-4276-97ec-534f851eb1d9

Donald Trump’s pick to be the nation’s chief trade negotiator Robert Lighthizer - a veteran lawyer who spent three decades fighting for punitive tariffs on U.S. companies’ overseas rivals http://www.wsj.com/articles/trumps-pick-for-trade-representative-signals-focus-on-curbing-imports-1483466041?

Ford Motor Co. is scrapping a plan to build a $1.6 billion small-car factory in Mexico after Donald Trump slammed the investment for more than a year, with company executives attributing the move to slumping demand for compact cars and optimism over the president-elect’s “pro-growth” strategies. http://www.wsj.com/articles/trump-targets-gm-on-chevy-cruzes-imported-from-mexico-1483448986?

Solar Could Beat Coal to Become the Cheapest Power on Earth by Jessica Shankleman and Chris Martin January 3, 2017 -- The average 1 megawatt-plus ground mounted solar system will cost 73 cents a watt by 2025 compared with $1.14 now, a 36 percent drop, said Jenny Chase, head of solar analysis for New Energy Finance. That’s in step with other forecasts. https://www.bloomberg.com/news/articles/2017-01-03/for-cheapest-power-on-earth-look-skyward-as-coal-falls-to-solar

21 Dec 2016: OPEC, non-OPEC agree to trim almost 2 million b/d next year, Ringgit Dips to Weakest Since 1998 AFC, Equities Traders Happy as Fear Infects Bonds, Brent Crude $55.54

OPEC Deal Makes Oil Investors Most Bullish Since Slump Began by Mark Shenk December 19, 2016 -- Net-long position climbs to highest since July 2014: CFTC, OPEC, non-OPEC agree to trim almost 2 million b/d next year https://www.bloomberg.com/politics/articles/2016-12-19/opec-deal-leaves-oil-investors-most-optimistic-since-slump-began

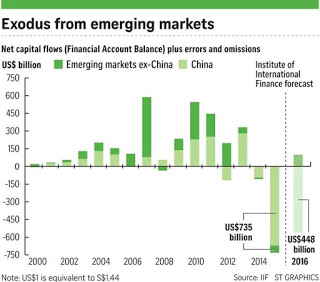

Ringgit Dips to Weakest Level Since 1998 Asia Financial Crisis by Y-Sing Liau and Netty Idayu Ismail December 19, 2016 -- Malaysia’s ringgit touched its lowest level since the Asian financial crisis in 1998, as investors continue to sell down emerging-market assets and after a crackdown on currency speculators last month exacerbated outflows. https://www.bloomberg.com/news/articles/2016-12-19/ringgit-dips-to-weakest-level-since-1998-asia-financial-crisis

Equities Traders Target a Happy New Year as Fear Infects Bonds by Garfield Clinton Reynolds December 20, 2016, VIX gauge for S&P 500 is dropping toward the lowest since 2014 https://www.bloomberg.com/news/articles/2016-12-20/equities-traders-target-a-happy-new-year-as-fear-infects-bonds

Bond volatility elevated after worst rout since 1990s

The record-setting U.S. stock rally is wiping out almost any hint of fear for equity investors as this turmoil-filled year in global markets draws to a close. Bond and currency traders face a more complicated future.

A $33 Billion Manager Who Bought at Low Shifts to Cash by Tom Redmond December 18, 2016 https://www.bloomberg.com/news/articles/2016-12-18/a-55-billion-manager-who-bought-at-market-low-returns-to-cash

Why You Might Want to Pass on the Shrimp Cocktail December 20, 2016 -- Bloomberg Businessweek's Megan Murphy reports on antiobiotic-tainted seafood from China. She speaks on "Bloomberg Markets." https://www.bloomberg.com/news/videos/2016-12-19/why-you-might-want-to-pass-on-the-shrimp-cocktail

China's Tiger Moms Are Spending Big on Tech Classes for Their Kids by Lulu Yilun Chen December 20, 2016 https://www.bloomberg.com/news/features/2016-12-20/china-s-tiger-moms-are-spending-thousands-for-stem-education-and-robot-classes-for-their-kids

2 Dec 2016: OPEC deal pushes up oil price, Trump trades created massive November for markets, China worries about yuan and cash outflow, China-Singapore angst, Brent crude $53.52

OPEC Deal Hinged on 2 a.m. Phone Call and It Very Nearly Failed by Javier Blas and Grant Smith December 1, 2016 — 7:01 PM EST -- Saudi call with Russia led to first supply cut since 2008. Deal finally gets struck after Indonesia is sidelined. After months of meetings from Doha to Moscow, it was a 2 a.m. phone call between two of the most powerful men in the global oil industry that finally broke the impasse..... https://www.bloomberg.com/news/articles/2016-12-02/opec-deal-hinged-on-2-a-m-phone-call-and-it-very-nearly-failed

Brent Oil Jumps to Highest in More Than a Year After OPEC Accord by Mark Shenk November 30, 2016 — 6:28 PM EST December 1, 2016 — 3:49 PM EST xporter group agrees to reduce production in landmark deal. https://www.bloomberg.com/news/articles/2016-11-30/oil-rally-holds-after-opec-deal-as-focus-shifts-to-execution

Energy companies are biggest winners in European markets.

OPEC Confounds Skeptics, Agrees to First Oil Cuts in 8 Years by Nayla Razzouk , Angelina Rascouet , and Golnar Motevalli November 30, 2016 — 8:25 AM EST November 30, 2016 — 10:54 PM EST -- Broader than expected agreement to include non-OPEC countries. Benchmark Brent crude prices climb in London to top $50

https://www.bloomberg.com/news/articles/2016-11-30/opec-said-to-agree-oil-production-cuts-as-saudis-soften-on-iran

Wall Street Wins Again as Trump Picks Bankers, Billionaires by Max Abelson November 30, 2016 -- Mnuchin would be third Goldman Treasury secretary since 1990s. ‘I think Donald Trump conned them,’ says hedge fund manager. https://www.bloomberg.com/news/articles/2016-11-30/wall-street-wins-again-as-trump-chooses-bankers-and-billionaires

Dollar Slips With Asian Stocks as New Angst Unseats Trump Trades by Emma O'Brien and En Han Choong December 1, 2016 — 5:55 PM EST December 1, 2016 — 7:55 PM EST https://www.bloomberg.com/news/articles/2016-12-01/asian-futures-signal-stock-retreat-as-trump-trade-loses-momentum

Why November Was a Massive Month for Markets Around the World - Last month changes everything by Sid Verma December 1, 2016 — 8:49 AM EST https://www.bloomberg.com/news/articles/2016-12-01/why-november-was-a-massive-month-for-markets-around-the-world

China's Central Bank Is Facing a Major New Headache Bloomberg News December 1, 2016 — 11:01 AM EST December 1, 2016 — 7:12 PM EST Economist: It may take a while before the situation stabilizes. Central bank focus for yuan seen shifting as FX reserves bleed. People’s Bank of China Governor Zhou Xiaochuan already has one policy headache with the currency falling to near an eight-year low. He could have an even bigger one next month.

https://www.bloomberg.com/news/articles/2016-12-01/pboc-s-headache-to-worsen-as-new-50-000-conversion-quota-looms

China-Singapore Tensions Spill Into Open After Customs Spat Bloomberg News November 30, 2016 — 4:00 PM EST December 1, 2016 — 4:26 AM EST -- Protest over military shipment from Taiwan seen as warning. Beijing concerned Singapore moving too far into U.S. orbit. https://www.bloomberg.com/news/articles/2016-11-30/china-singapore-tensions-spill-into-public-view-via-customs-spat

29 Sep 2016: OPEC agrees to freeze on Saudi u-turn but Russia output awaited, China property and GMO uncertainty, Deutsche Bank woes, Brent crude $48.78

In U-Turn, Saudis Choose Higher Prices Over Free Oil Markets by Javier Blas Grant Smith September 29, 2016 http://www.bloomberg.com/news/articles/2016-09-28/in-u-turn-saudis-pick-cash-over-flirting-with-free-oil-markets

OPEC Agrees to First Oil Output Cut in Eight Years by Grant Smith Angelina Rascouet Wael Mahdi September 29, 2016 http://www.bloomberg.com/news/articles/2016-09-28/opec-said-to-agree-on-first-oil-output-cut-in-eight-years

Saudi Arabia unveils first public sector pay cuts 27 September 2016 -- A royal decree said ministers' salaries would be reduced by 20%, and housing and car allowances for members of the advisory Shura Council cut by 15%. Lower-ranking civil servants will see wage increases suspended, and overtime payments and annual leave capped. About two-thirds of working Saudis are employed in the public sector. Their salaries and allowances accounted for 45% of government spending in 2015. http://www.bbc.com/news/world-middle-east-37482690

China's Red-Hot Property Market Risks Missing Lessons From Japan's Crash by Bloomberg News September 29, 2016 http://www.bloomberg.com/news/articles/2016-09-28/china-s-bubble-trouble-risks-missing-lessons-from-japan-s-crash

Why People Have Been Worrying About Deutsche Bank, in 12 Charts - The bank's troubles, in pictures. BY Sid Verma September 28, 2016 http://www.bloomberg.com/news/articles/2016-09-28/why-people-have-been-worrying-about-deutsche-bank-in-12-charts

China Wants GMOs. The Chinese People Don't. SEP 27, 2016 -- On Wednesday, China's Ministry of Agriculture responded to a social media storm by suspending operations at the center.... That might take care of the current scandal, but the Chinese public's hostility toward GMOs won't go away so easily. Those concerns have only grown over the past decade as the government has increased its support of GMOs, including approval of the state-owned ChinaChem Group's $43 billion takeover offer for the Swiss seed giant Syngenta.... These efforts have galvanized a very public opposition that transcends China's typical political fault lines, and created one of the government's most intractable headaches....https://www.bloomberg.com/view/articles/2016-09-28/china-wants-gmos-the-chinese-people-don-t

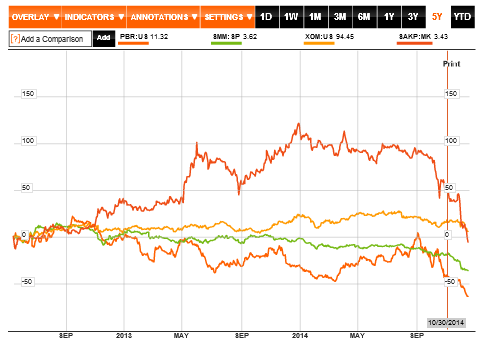

19 Sep 2016: Middle East producers opened the taps, Brent Crude $46.27

Source: Bloomberg.com 5-year price chart

OPEC production rose last month as Middle East producers opened the taps, the IEA said. Saudi Arabia, Kuwait and the United Arab Emirates pumped at or near record levels and Iraq pushed output higher, according to the agency.

http://www.bloomberg.com/news/articles/2016-09-18/oil-investors-flee-as-opec-freeze-hopes-face-supply-glut-reality14 Sep 2016: Oil S&D is not going to balance in 2016 after all, exotic routes on the rise, Hanjin fallout, Brent Crude $47.36

IEA Changes View on Oil Glut, Sees Surplus Enduring in 2017 Grant Smith September 13, 2016 -- Faltering Asian demand has weighed on consumption this quarter. Market set for fourth year of surplus as Gulf OPEC pumps more....World oil stockpiles will continue to accumulate through 2017, a fourth consecutive year of oversupply, according to the IEA. Consumption growth sagged to a two-year low in the third quarter as demand faltered in China and India, while record output from OPEC’s Gulf members is compounding the glut, it said. Just last month the agency predicted the market would return to equilibrium this year...... http://www.bloomberg.com/news/articles/2016-09-13/iea-changes-view-on-oil-glut-sees-oversupply-persisting-in-2017

The Crazy, Mixed-Up Global Oil Market - Algerian oil finds an unlikely home far away in Australia when cheap shipping redraws long established trade routes September 13, 2016

http://www.bloomberg.com/news/articles/2016-09-13/the-crazy-mixed-up-global-oil-market

Hanjin Brings One of World's Busiest Shipping Terminals Close to Standstill Heejin Kim September 14, 2016 http://www.bloomberg.com/news/articles/2016-09-13/last-holdout-in-korean-war-sees-once-busy-docks-idled-by-hanjin

Hanjin Fall Is Lehman Moment for Shipping, Seaspan CEO Says Rishaad Salamat Kyunghee Park September 13, 2016 http://www.bloomberg.com/news/articles/2016-09-13/hanjin-s-fall-is-lehman-moment-for-shipping-seaspan-ceo-says

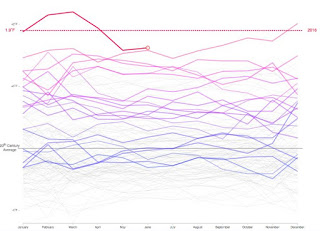

Fires, Floods, and Scorchers: Earth Destroys Yet Another Heat Record - July was the hottest on record, the 15th consecutive record-breaking month. August 18, 2016 Tom Randall

http://www.bloomberg.com/news/features/2016-08-17/fires-floods-and-scorchers-earth-destroys-yet-another-heat-record

18 August 2016: Saudi Stabilization Talk, China fishery and Silk Road, Brent Crude $49.78

Oil on Brink of Bull Market Amid Saudi Stabilization Talk: Chart by Ben Sharples August 18, 2016 http://www.bloomberg.com/news/articles/2016-08-18/oil-on-brink-of-bull-market-amid-saudi-stabilization-talk-chart

Indonesia Palm Exports Seen at 3-Month High on China Demand by Yoga Rusmana, Eko Listiyorini August 18, 2016 — Shipments seen 6.7% higher in July as China, India buy more. Inventories fall 4.4%, while output rises 0.5%, survey shows. Palm oil shipments from Indonesia, the world’s largest grower, probably rose to the highest level in three months in July after buyers from China to India boosted purchases.... http://www.bloomberg.com/news/articles/2016-08-18/indonesia-palm-exports-seen-at-three-month-high-on-china-demand

Rupiah’s Five Year of Losses Seen Ending by Top Forecaster by Lilian Karunungan August 18, 2016 http://www.bloomberg.com/news/articles/2016-08-17/rupiah-seen-ending-five-years-of-losses-on-11-billion-inflows

Singapore Non-oil domestic exports dropped 10.6 percent in July from a year earlier, worse than the median estimate of a 2.5 percent decline... That compares with a revised 2.4 percent decline in June... the Monetary Authority of Singapore signaled it’s not ready for a second-round of easing after an unexpected move in April http://www.bloomberg.com/news/articles/2016-08-17/singapore-s-export-decline-deepens-again-local-dollar-falls

Malaysia Plans Legal Moves Against Any 1MDB Defrauders, Low Says by Pooi Koon Chong August 18, 2016 http://www.bloomberg.com/news/articles/2016-08-18/malaysia-plans-legal-moves-against-any-1mdb-defrauders-low-says

Malaysia oil tanker 'not hijacked' despite earlier reports 17 August 2016 http://www.bbc.com/news/world-asia-37103871

Cathay Says Premium Travel Slumping, Prompting Discounts by Kyunghee Park August 18, 2016 -- The lack of first and business-class travelers from the Asian financial center -- the worst since the global financial crisis days of 2009 -- is such a dent on Cathay’s financials that analysts are asking whether Chief Executive Officer Ivan Chu needs to find a Plan B. http://www.bloomberg.com/news/articles/2016-08-17/cathay-pacific-says-premium-travel-slumping-prompting-discounts

China's Empty Oceans - Aug 17, 2016 5:00 PM EST By Adam Minter -- On Wednesday, Indonesia celebrated its Independence Day with a bang -- blowing up several Chinese boats that had been caught fishing illegally in its waters and impounded. China doesn't dispute Indonesia's territorial claims, but Chinese fishermen have more pressing concerns. According to reports in Chinese state media this week, overfishing and pollution have so depleted China's own fishery resources that in some places -- including the East China Sea -- there are virtually "no fish" left. That's a frightening prospect for an increasingly hungry country: China accounted for 35 percent of the world's seafood consumption in 2015. Seeking catches further afield -- including in Indonesian waters -- isn't really a solution; fish stocks in the disputed South China Sea have themselves fallen by as much as 95 percent from 1950s levels. If China doesn't want the rest of Asia's fisheries to suffer the same fate as its own, it's going to have to think much more ambitiously about how to create a sustainable food supply for the region. https://www.bloomberg.com/view/articles/2016-08-17/it-s-up-to-china-to-save-asia-s-oceans

Xi Seeks to Address Concerns Over China’s New ‘Silk Road’ Plan by Ting Shi August 18, 2016 http://www.bloomberg.com/news/articles/2016-08-18/xi-seeks-to-address-concerns-over-china-s-new-silk-road-plan

30 July 2016: Oil Giants worst profits trend, Singapore oil services badly hit, The Death of the Central Bank? IMF admits disastrous love affair with the euro, We need a rethink toward wealth by Stephen Hawking. Brent crude $43.53

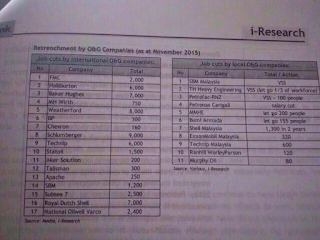

Oil Giants Find There’s Nowhere to Hide From Doomsday Market by Joe Carroll July 29, 2016 -- Exxon posts worst profit in 17 years, missing estimates. Chevron’s third straight loss capped longest streak in decades. Exxon Mobil Corp. and Royal Dutch Shell Plc this week reported their lowest quarterly profits since 1999 and 2005, respectively. Chevron Corp.’s third straight loss marked the longest slump in 27 years, and BP Plc lodged its lowest refining margins in six years. Welcome to year two of a supply overhang so persistent it’s upsetting industry expectations that the market would return to a state of balance between production and demand. It’s left analysts befuddled and investors running to the doorways as the crude market threatened to tip into yet another bear market, dashing hopes that a slump that began in mid 2014 would show signs of abating. http://www.bloomberg.com/news/articles/2016-07-29/exxon-mobil-profit-slumps-as-global-oil-glut-spreads-to-fuel

Supercomputers Deliver $500 Million Savings in BHP Hunt for Oil by David Stringer July 29, 2016 http://www.bloomberg.com/news/articles/2016-07-29/supercomputers-deliver-500-million-savings-in-bhp-hunt-for-oil

Swiber Drops Liquidation Plans Following Talks With Creditor by Andrea Tan and Joyce Koh July 30, 2016 -- Swiber Holdings Ltd., the Singapore-based offshore oil and gas services group, said it is dropping liquidation plans and intends to restructure its business following talks with the company’s major financial creditor. http://www.bloomberg.com/news/articles/2016-07-30/swiber-drops-liquidation-plans-following-talks-with-creditor

Morgan Stanley Warns Currency Traders Worst to Come for Dollar by Rebecca Spalding July 30, 2016 —- The dollar is set to fall 5 percent in the next few months, the Federal Reserve isn’t raising interest rates anytime soon and U.S. economic data is only going to get worse. http://www.bloomberg.com/news/articles/2016-07-30/morgan-stanley-warns-currency-traders-worst-to-come-for-dollar

The Death of the Central Bank By Michael Schuman JULY 29, 2016 -- For the past 70 years, Japan has been a crucible of experimentation in economic policy. During its go-go years, Tokyo’s unusual practices to spur rapid growth became a model for much of the rest of Asia, while its unconventional attempts to revive its post-bubble economy have helped economists understand what should and could be done to recover from financial crises.... Now Japan may be offering the world yet another lesson in economics -- on the outer limits and ultimate effectiveness of monetary policy itself. http://www.bloomberg.com/view/articles/2016-07-29/monetary-policy-runs-out-of-room-in-japan

IMF admits disastrous love affair with the euro and apologises for the immolation of Greece BY Ambrose Evans-Pritchard 29 JULY 2016 -- The International Monetary Fund’s top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory. ....It describes a “culture of complacency”, prone to “superficial and mechanistic” analysis, and traces a shocking breakdown in the governance of the IMF, leaving it unclear who is ultimately in charge of this extremely powerful organisation. The report by the IMF’s Independent Evaluation Office (IEO) goes above the head of the managing director, Christine Lagarde. It answers solely to the board of executive directors, and those from Asia and Latin America are clearly incensed at the way European Union insiders used the fund to rescue their own rich currency union and banking system....http://www.telegraph.co.uk/business/2016/07/28/imf-admits-disastrous-love-affair-with-euro-apologises-for-the-i/

US 2016 ELECTIONS - The TPP Isn't Just a Trade Deal JULY 29, 2016 By Noah Smith -- The Trans-Pacific Partnership, a multilateral trade deal involving the U.S. and many countries on the Pacific Rim, has become something of a bugaboo for those both on the left and the right. Republican nominee Donald Trump has denounced TPP, declaring it a sop to China, even though China isn't included in the agreement. Bernie Sanders is against it as well. President Barack Obama and Democratic vice presidential nominee Tim Kaine are for it, while Hillary Clinton, who helped negotiate the deal, has now turned against it. It’s not clear what Americans in general actually think about the treaty -- polls indicate lukewarm support, and Americans tend to view foreign trade as an opportunity rather than a threat. But it’s obvious that there are very vocal, committed minorities in both parties who are adamantly opposed to the deal, and both nominees appear to be giving them what they want. That’s odd, because the TPP is pretty innocuous and incremental stuff.... Instead, I see the TPP as a scapegoat for people who are -- justifiably -- angry about the China trade explosion that happened a decade ago. Killing TPP wouldn’t bring back any of the jobs that the U.S. lost in the 2000s, but it would be a stinging public rebuke to internationalists like Clinton and Obama -- a message that Americans are fed up with technocratic meddling done in the name of economic efficiency. That in and of itself isn't too worrying. Killing the TPP won’t do much economic harm. And with the countries showing little willingness to do big global trade deals, the free-trade agenda has mostly already ground to a halt all on its own. Also, I agree with the idea that technocrats have been too blasé about ignoring the distributional issues that arise from policies like free trade. http://www.bloomberg.com/view/articles/2016-07-29/the-tpp-isn-t-just-a-free-trade-deal

Our attitude towards wealth played a crucial role in Brexit. We need a rethink By Stephen Hawking -- Money was a key factor in the outcome of the EU referendum. We will now have to learn to collaborate and to share 29 July 2016 -- I don’t know what I would do with a racehorse, or indeed a Ferrari, even if I could afford one. So I have come to see money as a facilitator, as a means to an end – whether it is for ideas, or health, or security – but never as an end in itself.... Interestingly this attitude, for a long time seen as the predictable eccentricity of a Cambridge academic, is now more widely shared. People are starting to question the value of pure wealth. Is knowledge or experience more important than money? Can possessions stand in the way of fulfilment? Can we truly own anything, or are we just transient custodians?... https://www.theguardian.com/commentisfree/2016/jul/29/stephen-hawking-brexit-wealth-resources

11 July 2016: Asian Shares Jump With Won After U.S. Payrolls Boost; Oil Falls, Brent Crude $46.33

Asian Shares Jump With Won After U.S. Payrolls Boost; Oil Falls by James Regan Emma O'Brien July 11, 2016 — Yen slips as Abe election win raises prospect of stimulus. Crude sinks toward $45 after more rigs activated in the U.S. Asian stocks jumped the most since March and South Korea’s won surged after a bigger-than-expected pickup in U.S. hiring damped concern the world’s biggest economy is losing momentum. Gold rose, while oil declined. http://www.bloomberg.com/news/articles/2016-07-10/asian-stock-futures-pace-u-s-jump-after-payrolls-yen-steadies

Transocean’s Junk Bond Sale Shows Investors Still Fear Energy by Claire Boston July 9, 2016 -- After a two-week drought, debt investors showed they’re willing to start lending to junk-rated borrowers again. But they’re still apprehensive when it comes to energy companies. That’s what happened this week when off-shore driller Transocean Ltd. came to the bond market with plans to raise $1.5 billion. The company ended up trimming the deal to $1.25 billion and had to boost yields to entice investors. Transocean was the first junk-rated company to sell bonds since just before June 23, when the U.K. voted to leave the European Union and issuance of speculative-grade debt in both the U.S. and Europe ground to a halt. And while a rebound in oil prices this year has boosted the value of bonds sold by riskier energy companies, parts of that industry still haven’t recovered, according to Jake Leiby an analyst at debt research firm CreditSights. “They’re in a tough industry,” Leiby said. “Off-shore drilling has been hit the hardest of the energy subsectors in the downturn. It’s generally higher cost and longer cycle than other options.” http://www.bloomberg.com/news/articles/2016-07-08/transocean-s-junk-bond-sale-shows-investors-still-fear-energy

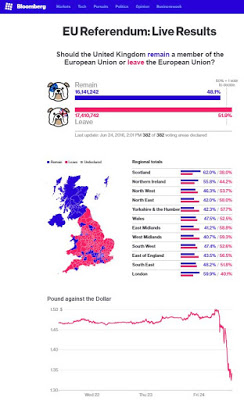

24 June 2016 (2.30pm Singapore time): Britain votes to exit EU, volatility hits, Brent crude $48.39

Editor's note: Talking to someone from financial sector, one of the reaction is "volality is good for trading." Bloomberg news links below. Despite the moans, financial sector might be quite pleased at the trading and business opportunities from the volatility and risk concerns. There have been analysis showing a big gap of haves versus have-nots (similar to after the 1929 boom period) and also the middle-class squeeze. We see resilient regimes in Southeast Asia (including the special circumstances of the Singapore-Malaysia political-economies). They includes a major difference - recent decades of middle class expansion. But there has also been some (very) recent angst on migrant labour suppression on domestic wages and earnings.

http://www.bloomberg.com/graphics/2016-brexit-referendum/

Commodities Reel in World Market Tumult as U.K. Votes for Brexit http://www.bloomberg.com/news/articles/2016-06-24/commodities-reel-in-world-market-tumult-as-u-k-votes-for-brexit

Oil Glut Is Fading Where You Would Least Expect: Saudi Arabia http://www.bloomberg.com/news/articles/2016-06-23/oil-glut-is-fading-where-you-would-least-expect-saudi-arabia

Revealing the Biggest Winners and Losers From U.K. Vote to Leave - Former London Mayor Boris Johnson gets a boost, while big banks face a world of chaos http://www.bloomberg.com/news/articles/2016-06-24/revealing-the-biggest-winners-and-losers-from-u-k-vote-to-leave

‘Panic Is Palpable’ as Markets Swoon on Brexit Vote Few Expected http://www.bloomberg.com/news/articles/2016-06-24/keep-calm-is-trading-floor-mantra-as-markets-look-anything-but

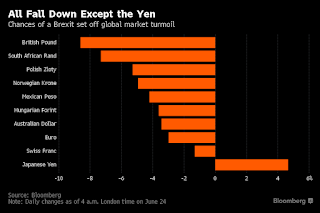

U.K. Referendum Roils Global Currencies From Australia to Mexico

http://www.bloomberg.com/news/articles/2016-06-24/u-k-referendum-roils-global-currencies-from-australia-to-mexico

21 June 2016: Bloomberg - Oil halts advance, Brexit, trade war concerns, Brent crude $50.37

Oil Halts Advance Near $49 a Barrel Before U.S. Stockpile Data by Ben Sharples June 21, 2016 http://www.bloomberg.com/news/articles/2016-06-21/oil-halts-advance-near-49-a-barrel-before-u-s-stockpile-data

Crude Oil Declines in New York as Canadian Output Ramps Up by James Paton June 21, 2016 http://www.bloomberg.com/news/articles/2016-06-20/crude-oil-declines-in-new-york-as-canadian-output-ramps-up

It’s 1995 Again for Dollar Traders Bracing for Trade War Trouble by Taylor Hall June 21, 2016 -- Clinton, Trump advocate tougher stance with major partners, JPMorgan says export-import disputes weaken the greenback http://www.bloomberg.com/news/articles/2016-06-20/it-s-1995-again-for-dollar-traders-bracing-for-trade-war-trouble

What Brexit Would Mean for Asia's Economies by Colin Simpson June 21, 2016 http://www.bloomberg.com/news/articles/2016-06-20/what-brexit-would-mean-for-asia-s-economies

Stocks Gain With Pound, Treasuries Drop as Brexit Concern Fades by Lukanyo Mnyanda Jeremy Herron June 20, 2016 http://www.bloomberg.com/news/articles/2016-06-19/risk-appetite-revived-as-brexit-odds-ebb-pound-jumps-yen-falls

16 June 2016: Commodity price rally 'still in early stages', says Hightower

Commodity price rally 'still in early stages', says Hightower By Agrimoney.com - Published 14/06/2016. The commodities rally is still in its early stages, leading commentator David Hightower told the Agrimoney Investment Forum, flagging the growing demand for ags from emerging market countries. "We are much closer to the bottom for commodity prices than to a high," Mr Hightower, founder of the influential Chicago-based Hightower Report said. "If you think you have missed the commodities move – think again." He highlighted that even now - after commodities prices have risen by 12.3% this year, as measured by the Bcom index – they remain well below historic highs. The Bcom index, which closed on Monday at 88.3 points, approached 240 points in July 2008, at the peak of the last commodities boom. And analysis of supply and demand fundamentals offered reasons why the values of raw materials, including ags, may return closer to highs. 'Prices will need to go very high' "Commodity prices cannot be kept down, because costs of production are too close to where prices have been for the last six months to one year," Mr Hightower told the Agrimoney Investment Forum, in London. Markets had been "pricing for perfection" in output, leaving them vulnerable to a rally on any kind of production, or demand, surprise.".....

14 June 2016: Fossil fuels for electricity to peak on cheaper alternatives, Brexit angst, market rallies retreat, China financial worries speculation, Brent 49.86

Bloomberg news:

- The World Nears Peak Fossil Fuels for Electricity - Coal and gas will begin their terminal decline in less than a decade, according to a new BNEF analysis.... Call it peak fossil fuels, a turnabout that's happening not because we're running out of coal and gas, but because we're finding cheaper alternatives. Demand is peaking ahead of schedule because electric cars and affordable battery storage for renewable power are arriving faster than expected, as are changes in China's energy mix. .. http://www.bloomberg.com/news/articles/2016-06-13/we-ve-almost-reached-peak-fossil-fuels-for-electricity

- Asian Stocks Battered by Brexit Angst as Pound Falls; Bonds Jump http://www.bloomberg.com/news/articles/2016-06-13/brexit-angst-hits-asian-stock-outlook-as-pound-sinks-yen-climbs

- So Long to Hong Kong's World-Beating Rally http://www.bloomberg.com/news/articles/2016-06-13/so-long-to-world-beating-hong-kong-rally-as-stocks-resume-slide

- ‘Smoldering Bonfire’ Shows Where Kyle Bass May Be Right on China - Kyle Bass, the U.S. investor known for betting against subprime mortgages, is among famous money managers who expect turmoil in a Chinese banking industry struggling with bad loans. It’s in the least-known corners of the financial system that their predictions could start to come true...“A small bank may face a liquidity problem if their investments are in default and that will trigger a domino effect,” said Patricia Cheng, a Hong Kong-based analyst at brokerage CLSA Ltd. “Any failure of a financial institution will hurt sentiment and the psychological effects just can’t be quantified.”.... http://www.bloomberg.com/news/articles/2016-06-13/-smoldering-bonfire-shows-where-kyle-bass-may-be-right-on-china

30 May 2016: China Default Chain Reaction Threatens Products Worth 35% of GDP, Noble Group CEO Quits, Brent Crude 49.16

Noble Group CEO Quits as Energy Solutions Business Put on Sale by Ranjeetha Pakiam Jasmine Ng May 30, 2016 http://www.bloomberg.com/news/articles/2016-05-30/noble-group-ceo-alireza-quits-as-part-of-energy-unit-put-on-sale

Noble Cuts to the Core By Christopher Langner, David Fickling May 30, 2016 http://www.bloomberg.com/gadfly/articles/2016-05-30/noble-investors-will-hope-alireza-was-wrong-about-energy-unit

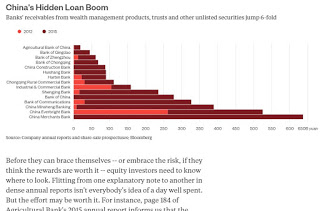

China's Veiled Loans May Prove Lethal By Andy Mukherjee May 30, 2016

http://www.bloomberg.com/gadfly/articles/2016-05-30/china-s-veiled-loans-present-a-lethal-hidden-danger

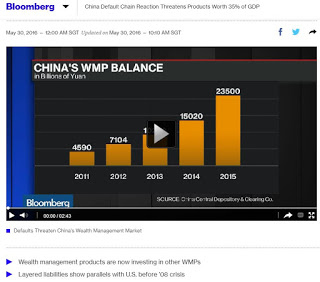

http://www.bloomberg.com/news/articles/2016-05-29/china-default-chain-reaction-threatens-products-worth-35-of-gdp

22 April 2016: Bloomberg - Commodities roaring back, Soros worries about China's debt-fueled growth, Brent Crude 44.95

Commodities Make a Comeback as Bad Weather Meets Chinese Demand, April 22, 2016 - `The situation is better than people had given credit'. Strong China data and restocking season behind metals rally http://www.bloomberg.com/news/articles/2016-04-21/commodities-make-a-comeback-as-bad-weather-meets-chinese-demand

The $2 Trillion Project to Get Saudi Arabia’s Economy Off Oil - Eight unprecedented hours with “Mr. Everything,” Prince Mohammed bin Salman. April 21, 2016 by Peter Waldman

http://www.bloomberg.com/news/features/2016-04-21/the-2-trillion-project-to-get-saudi-arabia-s-economy-off-oil?cmpid=BBD042116_BIZ&utm_medium=email&utm_source=newsletter&utm_campaign=

Soros Says China's Debt-Fueled Growth Echoes U.S. in 2007-08 April 21, 2016 http://www.bloomberg.com/news/articles/2016-04-20/soros-says-china-s-debt-fueled-economy-resembles-u-s-in-2007-08

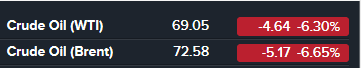

18 April 2016: Bloomberg - Oil Plunges After Output Talks Fail Amid Saudi Demands Over Iran, Brent Crude 40.87 -5.17% 8:30 PM

Oil Plunges After Output Talks Fail Amid Saudi Demands Over Iran Updated on April 18, 2016 — 7:05 AM SGT http://www.bloomberg.com/news/articles/2016-04-17/oil-freeze-talks-end-in-failure-amid-saudi-demands-over-iranDoha Failure Sees Loonie, Aussie Slide; Yen Near 1 1/2-Year High http://www.bloomberg.com/news/articles/2016-04-17/yen-jumps-commodity-linked-currencies-plunge-as-doha-talks-fail

Oil's Grand Bargain Falls Victim to Saudi Arabia's Iran Fixation http://www.bloomberg.com/news/articles/2016-04-17/oil-s-grand-bargain-falls-victim-to-saudi-arabia-s-iran-fixation

Emerging-Market Assets Roar Back to Life April 18, 2016 Short interest in largest stock, bond ETFs slumped to about 2%. Morgan Stanley says growth pickup needed for rally to continue. http://www.bloomberg.com/news/articles/2016-04-17/bears-fleeing-fast-as-emerging-market-assets-roar-back-to-life

17 April 2016: Doha Oil Talks Start After Delay, Wall Street's Oil Crash, Bank Indonesia Adopts New Policy Rate, Tapping into the Ocean's Energy, Brent Crude 43.10

Doha Oil Talks Start After Delay to Address Saudi Stance on Iran http://www.bloomberg.com/news/articles/2016-04-17/doha-oil-talks-start-after-delay-to-address-saudi-stance-on-iran

The bad smell hovering over the global economy by Larry Elliott; Attempts at economic stimulus have left a bad smell. Central banks are starting to think the unthinkable – helicopter money 17 April 2016 http://www.theguardian.com/business/2016/apr/17/central-bank-global-economy-helicopter-money

Tapping into the Ocean's Energy April 12, 2016, The oceans generate enough energy for us to give up coal and gas completely, but no one has been able to harness it effectively. The Triton is a wave harvester that uses a novel design which may be the key to unlocking the power of the ocean. (Source: Bloomberg) http://www.bloomberg.com/news/videos/2016-04-12/tapping-into-the-ocean-s-energy

Australia's Debt Levels Raise Downgrade Fears by Candice Zachariahs April 17, 2016 http://www.bloomberg.com/news/articles/2016-04-17/australia-s-1986-debt-downgrade-haunts-morrison-as-budget-nears

Wall Street's Oil Crash, a Story Told in Charts by Asjylyn Loder April 16, 2016 http://www.bloomberg.com/news/articles/2016-04-15/wall-street-s-oil-crash-a-story-told-in-charts

The Lessons of a Coal Giant's Collapse APRIL 15, 2016 By Editorial Board, The bankruptcy of Peabody Energy Corp., the largest U.S. coal producer, is the most vivid illustration yet of the market's deep and welcome shift away from coal. It could also be calamitous for the environment: If Peabody goes out of business, who will clean up the pollution it has left behind? http://www.bloombergview.com/articles/2016-04-15/the-lessons-of-peabody-energy-s-collapse

Bank Indonesia Adopts New Policy Rate to Help Boost Economy, April 15, 2016; Central bank moves to seven-day reverse repo rate from August. Bank Indonesia will reduce lending facility rate in August... http://www.bloomberg.com/news/articles/2016-04-15/bank-indonesia-adopts-new-policy-rate-to-help-boost-economy

Tapping into the Ocean's Energy April 12, 2016, The oceans generate enough energy for us to give up coal and gas completely, but no one has been able to harness it effectively. The Triton is a wave harvester that uses a novel design which may be the key to unlocking the power of the ocean. (Source: Bloomberg) http://www.bloomberg.com/news/videos/2016-04-12/tapping-into-the-ocean-s-energy

Australia's Debt Levels Raise Downgrade Fears by Candice Zachariahs April 17, 2016 http://www.bloomberg.com/news/articles/2016-04-17/australia-s-1986-debt-downgrade-haunts-morrison-as-budget-nears

13 April 2016: A rapid slide in production around the world, risk of price drop if freeze deals fails, Brent Crude 44.21 Brent Crude 44.21

The 10-Point. Gerard Baker Editor in Chief The Wall Street Journal, 13 April 2016 The debate among the biggest oil nations over whether to freeze output is beginning to be overtaken by a rapid slide in production around the world. The U.S. government said yesterday that national output dropped in March and will likely continue falling, and this morning OPEC said that production outside the cartel is falling more sharply than expected. Helped by speculation of a deal led by Russia and Saudi Arabia, the two biggest producers, at a meeting in Doha this weekend, oil prices recovered yesterday but they fell again this morning as profit-taking and pessimism over whether producers can agree to a freeze pulled the price down. Any deal could signal that the bottom of the oil-price rout has passed. Others in OPEC—including Venezuela, Iraq, Qatar, Kuwait and the U.A.E.—have said that they would likely go along with a Moscow-Riyadh-led agreement, but it remains unclear whether they would agree to a freeze if Iran, also an OPEC member, doesn’t participate.

Oil Producers Risk Severe Price Slump If Freeze Deal Fails by Grant Smith April 12, 2016 http://www.bloomberg.com/news/articles/2016-04-12/oil-producers-risk-severe-impact-on-prices-if-freeze-deal-fails

Coal Slump Sends Mining Giant Peabody Energy Into Bankruptcy by Tiffany Kary and Tim Loh April 13, 2016 http://www.bloomberg.com/news/articles/2016-04-13/peabody-majority-of-its-u-s-entities-file-for-chapter-11

World's Once-Biggest Gem Field Idle as $13 Billion Said Gone by Godfrey Marawanyika April 13, 2016

2 April 2016: Saudi Arabia says accord for production freeze needs Iran, glutted natural-gas summer could push producers into desperation, Tesla's new car gets $7.5 billion orders at launch, Brent crude 38.67

Crude Oil Prices Sink as Saudis Balk at Production Curbs - Doubts about the deal; `Kiss goodbye' to any hopes of agreement in Doha: Commerzbank. Russia says it wasn't aware of Saudi position on Iran http://www.bloomberg.com/news/articles/2016-04-01/saudi-arabia-plans-2-trillion-megafund-to-dwarf-all-its-rivals?cmpid=BBD040116_BIZ&utm_medium=email&utm_source=newsletter&utm_campaign=urboutput had already halted an oil price rebound By TIMOTHY PUKO and GEORGI KANTCHEV Updated April 1, 2016 http://www.wsj.com/articles/oil-prices-decline-ahead-of-u-s-data-1459503111?tesla=y

Saudi Arabia Plans $2 Trillion Megafund for Post-Oil Era: Deputy Crown Prince; Pot would be big enough to buy world's four largest companies. First step will be sale of Aramco stake by 2018, prince says. ; Saudi Arabia is getting ready for the twilight of the oil age by creating the world’s largest sovereign wealth fund for the kingdom’s most prized assets. http://www.bloomberg.com/news/articles/2016-04-01/saudi-arabia-plans-2-trillion-megafund-to-dwarf-all-its-rivals?cmpid=BBD040116_BIZ&utm_medium=email&utm_source=newsletter&utm_campaign=

No Mercy Rule for Glutted Natural-Gas Market - ‘Withdrawal season’ ends with record inventories, and summer could push producers into desperation By SPENCER JAKAB April 1, 2016 http://www.wsj.com/articles/no-mercy-rule-for-glutted-natural-gas-market-1459542004?tesla=y

Obama Acknowledges Mixed Legacy on Nuclear Nonproliferation - Success of his efforts to reduce nuclear threats hinge on his ability to rein in North Korea and Iran By CAROL E. LEE April 1, 2016 http://www.wsj.com/articles/obama-says-iran-making-real-progress-living-up-to-nuclear-deal-1459527637?tesla=y

12 Mar 2016: Bonuses at many energy companies based on higher oil production, hina Is Facing a Ticking Demographic Time Bomb

China Is Facing a Ticking Demographic Time Bomb - Getting old isn't easy on an economy by Aki Ito March 10, 2016 http://www.bloomberg.com/news/articles/2016-03-10/china-is-facing-a-ticking-demographic-time-bomb?cmpid=BBD031116_BIZ

Oil Freeze Thaws as Saudi Arabia Says Accord Hinges on Iran by Grant Smith http://www.bloomberg.com/news/articles/2016-04-01/oil-freeze-thaws-as-saudi-arabia-says-accord-hinges-on-iran

Economy Chugs On Despite Fears Slowdown worries fade as hiring, wage gains lift consumer spending; Fed still seen on hold By ANNA LOUIE SUSSMAN Updated April 1, 2016 http://www.wsj.com/articles/u-s-march-nonfarm-payrolls-rise-by-215-000-jobless-rate-5-0-1459513893?tesla=y

A Ride in Tesla's $35,000 Model 3: Musk's Master Plan Realized Dana Hull April 1, 2016; The Model 3 seats five and gets at least 215 miles per charge, a minimum Tesla hopes to exceed. It comes standard with autopilot hardware... http://www.bloomberg.com/news/articles/2016-04-01/a-ride-in-tesla-s-35-000-model-3-musk-s-master-plan-realized?cmpid=BBD040116_BIZ&utm_medium=email&utm_source=newsletter&utm_campaign=

5 year Bruent crude price chart: http://www.bloomberg.com/quote/CO1:COM

Key Formula for Oil Executives’ Pay: Drill Baby Drill - Bonuses at many energy companies based on higher oil production, reserves; shareholders seek change By RYAN DEZEMBER, NICOLE FRIEDMAN and ERIN AILWORTH Updated March 11, 2016 Markets have been waiting for U.S. energy producers to slash output during a period of depressed crude prices. But these companies have been paying their top executives to keep the oil flowing.... http://www.wsj.com/articles/key-formula-for-oil-executives-pay-drill-baby-drill-1457721329?tesla=y

Should I Buy Diamonds, Wine or Picasso? By Rani MollaAndrea Felsted'; You'd have thought negative interest rates would fuel a boom in diamonds, antiques and fine wine, as people look for an alternative to stuffing cash under the mattress. But you'd be wrong: prices for all three are falling.While some "collectibles" such as vintage watches, luxury handbags and old cars are holding up pretty well, others are struggling. The phenomenon of safe havens not always proving the best place to hide was explored by Gadfly colleague Nir Kaissar recently, who questioned gold, cash and real estate..... So while you may think your investments are uncorrelated, think again. As in other areas of economic life, China's influence is everywhere. If you're worried about its financial wellbeing, there might be some merit in that mattress after all. http://www.bloomberg.com/gadfly/articles/2016-03-11/china-is-why-not-to-invest-in-diamonds-wine-or-picasso?cmpid=BBD031116_BIZScenes From the Disaster Zone: Five Years on in Fukushima - Five years since the meltdown at the Fukushima Dai-Ichi nuclear power plant, progress has been made to rebuild much of the prefecture. Yet within evacuation zones designated by the Japanese government, scars are still obvious. Many evacuees who fled are unwilling to return. Thousands still live in temporary housing outside these zones. Photographs by Ko Sasaki and Tomohiro Ohsumi for Bloomberg http://www.bloomberg.com/news/photo-essays/2016-03-10/scenes-from-the-disaster-zone-five-years-on-in-fukushima?cmpid=BBD031116_BIZ

10 Mar 2016: Emerging-Market Rallies Cling to Bullish Signs as Oil Stabilizes, Brent Crude 40.83

Emerging-Market Rallies Cling to Bullish Signs as Oil Stabilizes http://www.bloomberg.com/news/articles/2016-03-10/emerging-market-moving-averages-turn-bullish-as-oil-stabilizes

Surge in Hong Kong Stock Buybacks Is Bullish Signal to HSBC http://www.bloomberg.com/news/articles/2016-03-09/surge-in-hong-kong-stock-buybacks-sends-bullish-signal-to-hsbc

29 Feb 2016: Bloomberg - Arab States Face $94 Billion Debt Crunch HSBC says, China Panic Calmed for Now, Leaders Face Reform Test, Malaysia Najib Cements Hold, Brent Crude $35

Arab States Face $94 Billion Debt Crunch on Oil Slump, HSBC Says http://www.bloomberg.com/news/articles/2016-02-28/hsbc-sees-94-billion-gulf-arab-debt-crunch-amid-oil-slump

With China Panic Calmed for Now, Leaders Face Reform Test Bloomberg News February 29, 2016 http://www.bloomberg.com/news/articles/2016-02-28/with-china-panic-calmed-for-now-leaders-face-reform-test

Malaysia Ruling Party Suspends Deputy as Najib Cements Hold by Manirajan Ramasamy Pooi Koon Chong February 28, 2016 http://www.bloomberg.com/news/articles/2016-02-28/malaysia-ruling-party-suspends-deputy-as-najib-cements-hold

23 Feb 2016: Bloomberg - The U.S. States Where Recession Is Already a Reality. Economist - Manufacturing - A hard pounding. Singapore worries about debt defaults. Yuan carry trade unwind concerns. Brent Crude 34.69

The U.S. States Where Recession Is Already a Reality. by Steve Matthews February 22, 2016; As economists size up the chances of the first nationwide slump since 2009, pockets of the country are already contracting. Four states—Alaska, North Dakota, West Virginia and Wyoming—are in a recession and three others are at risk of prolonged declines, according to indexes of state economic performance tracked by Moody’s Analytics....The regions suffering the most are in the flop stage of the energy industry’s boom-to-bust cycle, and manufacturing-dependent areas hurt by a rising dollar are at risk of receding. Whether the weak links break the entire U.S. economy will hinge largely on a group that’s benefited from the energy price collapse: American consumers.

“The impetus for weakening regional economies is the huge fall in energy prices and other commodities prices, which is taking a tremendous toll,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York, who is concerned of a broadening into a national recession. “If the consumer were to falter for any reason, that would be a big problem.” http://www.bloomberg.com/news/articles/2016-02-22/recession-already-reality-in-spots-from-west-virginia-to-wyoming?cmpid=BBD022216_BIZ