On 15 December 2023, Segi Enam attended the IDEAS-FedEx event on “Highlights on RCEP and how it can benefit your business”. The Regional Comprehensive Economic Partnership or RCEP came into force on 18 March 2022. It is one of the 16 free trade agreements (FTAs) that Malaysia is part of.

Source: MATRADE, 2022

The signatory countries are Malaysia, Brunei, Cambodia, Indonesia, Laos, Myanmar, Singapore, Thailand, the Philippines, Vietnam, Australia, China, Japan, New Zealand and South Korea; and pending ratification by Myanmar and the Philippines.

Source: MATRADE, 2022

The conference focused on increasing awareness of RCEP to businesses and its benefits.

Below are the speakers for the panel discussion:

During the panel discussion, Fahrulrazy from MITI pointed to the huge market under RCEP, specifically China and its approximately 1.4 billion population; including advantages to producers and manufacturers for sourcing raw materials within the trade area, to help increase productivity and growth. But specifics of using the provisions of RCEP versus other Malaysia-China trade arrangements e.g. China-ASEAN FTA or CAFTA were not elaborated on.

The speaker from Deloitte provided some comparison of tariffs from different trade agreements and used a few case study illustrations including on Malaysia petrochemicals exported to the Middle East via Indonesia. Interestingly, there was some disagreement between the speakers on which Rules of Origin or ROO to apply.

Concerns were raised by Dr Juita on the lack of labour and environmental chapters in the RCEP. There are 20 chapters in RCEP that covers ROO, Customs Procedures and Trade Facilitations, Sanitary, Trade in Services and Competition. You can find all the chapters here. The panel shared that it is difficult to get a consensus on human rights. All signatories must be ready to agree on it.

There were about 80 participants and they included business owners, agencies and regulators. The worries from the floor were on small-medium enterprises (SMEs) and their cost worries. For SMEs to participate in RCEP, there are costs to administer and apply to enjoy the provisions of RCEP (or other trade deals). SMEs have to be on their toes to understand which trade deal provisions they can avail themselves of; with constant monitoring and assessments. To this end, government support is vital. For example, the Singaporean government provides grants to SMEs to assess their readiness to export their products.

Moreover, there can also be risks to SMEs, most of the speakers cautioned on increased competition for certain sectors due to more imports. A key speaker pointed out that the agreement has come at the wrong time when many businesses are still recovering from the pandemic; and many SMEs will not have the financial capability to upgrade their businesses. There is an ongoing problem of SMEs not exporting, as they do not have the capacity to do so.

A participant pointed out that only major businesses in Malaysia are exporting. In fact, not many SMEs are using MATRADE programs. MATRADE was asked whether any studies were conducted to determine which Malaysian products would have a comparative advantage under RCEP (compared to trade competitors). As this study is ongoing, we should await the publication of its findings. The expected date of publication of this report was not disclosed.

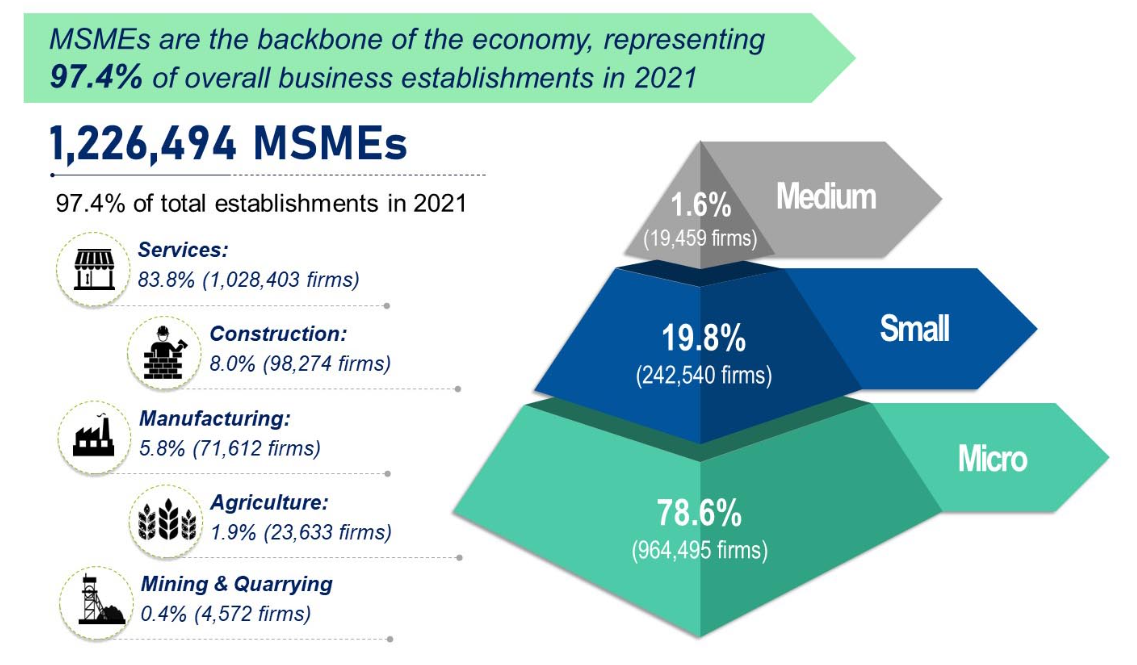

Note: MATRADE reported in 2019 that local SMEs only contributed about 18 per cent in export despite making up 98 per cent of Malaysian business establishments.

Source: MSME Performance in 2021, accessed January 2023

Slides and recordings of the conference can be found here.

From Segi Enam, we can share that doing a review of opportunities under different trade agreements is not a walk in the park. First, you need to narrow down your product codes, and which countries you are hoping to export to and export from. And if you are supplying equipment or ingredients, you may want to consider how trade deals impact the retail or industrial consumer markets you supply to. For instance, if you are supplying agro-chemicals, how does RCEP impact the trade in corn in the region?

In June 2021, we did a review for a Europe-based multinational supplier for two supply items (involving several HS codes) and three industrial consumer segments for six countries: China, Indonesia, Malaysia, Philippines, Thailand and Vietnam. Our general findings on RCEP include:

With existing ASEAN Plus Free Trade Area agreements which offers lower, zero rate preferential tariffs, RCEP could be more relevant to new trade partners.

Given the relative free trade ongoing under ATIGA and other ASEAN Plus trade deals, with rules of origin at 40%, and limited technical barriers; RCEP’s base rates tariff schedule (which vary by product and country) does not point to trade competitive changes. However, the base rate changes may be a useful reading or signal into the

Bottom-line: The report from the Malaysian authorities to hone in on which products and trade flows will be beneficial to Malaysia will be important for helping more SMEs into export readiness. Exporting SMEs should already be familiar with the market research needed to stay on top of their business and ahead of competitors. And they will know which are the key forms they need e.g. Certificate of Origin, to avail themselves of the trade provisions.

research@segi-enam.com | 9 Jan 2023